by Daniel | Last Updated May 29th, 2024

We may earn a commission for purchases using our links, at no cost to you.

If you’re considering getting one of the American Express Delta SkyMiles cards, or already have one and are looking to upgrade, then this article is for you.

Basically I’m going to talk you through how these 4 cards differ in terms of benefits and perks and which card is the best option for you.

Who Are These Cards Good For?

On a basic level, all of these cards are worth considering for anyone that tends to fly with Delta on a regular basis, mainly because a majority of the benefits on offer are directly related to Delta.

Then depending on how much you travel and what benefits you actually prefer will determine which card you should choose.

As you will see in the next section of this video, there is a wide range of perks and benefits available with each card.

With the entry level Amex Delta SkyMiles Blue card offering just a few benefits, all the way up to the Amex Delta SkyMiles Reserve card offering the most benefits.

Delta SkyMiles Blue American Express Card

So lets start by looking at the entry level Delta SkyMiles Blue American Express Card.

And this is the most cost effective card in the range to Delta SkyMiles cards, as it has on annual fee.

This card is great for anybody relatively new to credit cards that is looking for a way to start to take advantage of traveling with Delta.

Sign-up Bonus

So as I just mentioned there is no annual fee, and as a sign-up bonus it is possible to earn 10,000 bonus miles after you manage to spend just $1,000 on the card within a 6 month period.

And it shouldn’t be to hard to meet this spend requirement, as it works out to be just over $166 a month.

Now generally speaking, Delta SkyMiles are worth about 1.2 cents per mile, this means the 10,000 mile sign up bonus is worth about $120.

Benefits

In terms of benefits there isn’t that much on offer, but that is pretty normal for entry level cards like this.

The main stand out benefit with the Blue card is the ability to receive a 20% saving for inflight food and beverage purchases.

And I whilst this isn’t anything to get too excited about, it is better than nothing.

Another benefit that is a little more useful in my opinion is the Pay With Miles option.

This gives you ability to receive up to $50 off the cost of a flight for every 5,000 miles that you use to redeem when booking through delta.com

So technically speaking, you could save up to $100 off your next flight by redeeming the 10,000 mile sign up bonus through delta.com.

Earning Miles

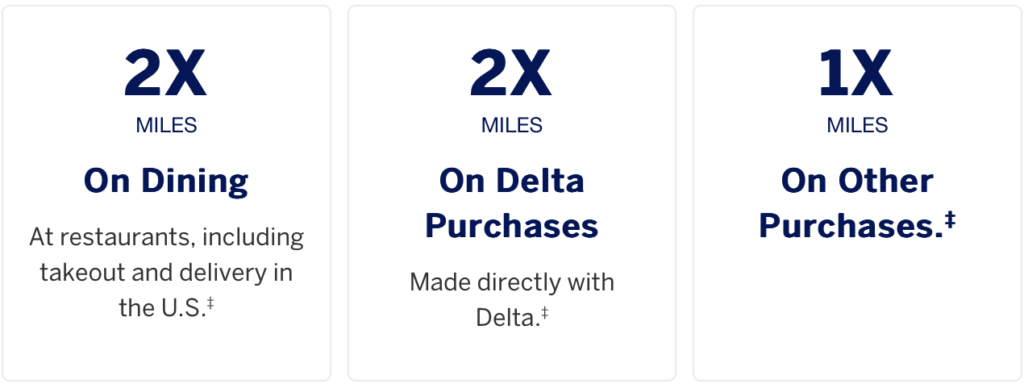

Now when it comes to earning miles, the Delta SkyMiles Blue Amex card offers a few categories where you can earn miles from.

And if you spend more money in the higher miles earning categories, you will get more value out of the card.

So if you dine out at restaurants in the US, or get take out or delivery, it is possible earn 2x miles.

Then all purchases that are made directly through Delta will also earn you 2x miles.

Anything else you use the card to pay for will earn you just 1 mile per dollar spent.

So whilst these categories don’t offer a huge return for each dollar you spend, over time they will start to provide you with a reasonable amount of value.

Delta SkyMiles Gold American Express Card

Now second card in the line up is the Delta SkyMiles Gold American Express Card.

And this card actually offers quite a lot more benefits and perks than the Blue card, but it also has an annual fee.

Basically, the first year of card ownership is totally free, then each year thereafter will cost you $150.

So this card is great for anyone that already uses Delta to travel and wants to get more value out of that travel.

It will require you to spend a certain amount to get some of the benefits on offer, but if you can manage to do this, it is worth it.

Sign-up Bonus

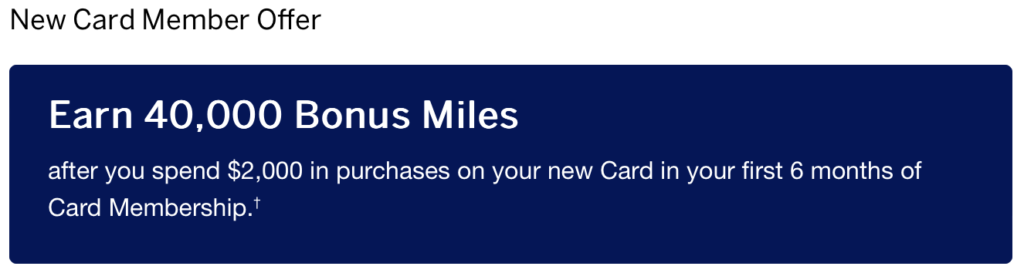

Now the signup bonus with the Gold card is a lot more valuable than what the Blue card is offering.

Basically, it is possible to earn 40,000 bonus miles if you manage to spend $2,000 on the card within the first 6 months of opening the account.

And whilst you will need to spend twice as much on the Gold card than the Blue card to receive the sign-up Bonus, it is essentially worth 4 times as much.

And with a spend requirement of around $333 a month for 6 months to receive to sign-up bonus, it shouldn’t be to hard to do.

Now as I said before, Delta SkyMiles are worth about 1.2 cents per mile, this means the 40,000 miles sign up bonus is worth about $480.

Thats a pretty decent amount of value for a card that has no annual fee for the first year.

Benefits

Now in terms of perks and benefits, the Gold card offers quite a lot more value than the Blue card.

The first and most notable benefit on offer is the ability to receive a $200 Delta Flight Credit after you spend $10,000 on the card within a calendar year.

Simply put, thats a spend of about $200 per week over the course of 12 months.

So if you know you will spend this much on the card each year, it is a nice benefit to have and it will also make up for the cost of the annual fee of $150.

Another useful benefit that is easy to receive is a $100 Delta Stays Credit.

Basically, if you use the card to book a hotel through Delta Stays you will receive a $100 credit.

Now another benefit that isn’t available with the Blue card is the ability to get your First Checked Bag Free.

This can actually save you a fair amount of money if you travel quite frequently, as it does cost $35 for your first checked bag.

One more benefit that is included with the Gold card and not the Blue card is the TakeOff 15 offer.

This gives you the ability to receive 15% off your booking when you use your own miles to book a flight.

The last benefit that is also not included with the Blue card is Priority Boarding, this means you will receive Main Cabin 1 Priority Boarding.

So if you like to get on the plane before a majority of the people do so, this is a nice benefit to have.

Specifically as you will be able to stow you carry on bags whilst there is still room in the overhead bins.

Then just like the Blue card you get the same 20% back on in flight purchases, and the ability to receive $50 off the cost of your flight for every 5,000 miles you redeem through Pay with Miles.

Earning Miles

Now in terms of earning miles, the Amex Delta SkyMiles Gold card is somewhat similar to the what the Blue card offers.

The main difference is that you can also earn 2x miles for purchases made a US supermarket.

This can actually make a substantial difference to the amount of miles you earn, as we all need to eat, and I don’t know about you, but I spend quite lot of money on groceries each week.

Everything else is the same as the blue card, with the ability to earn 2x miles on dining in the US, 2x miles for direct Delta purchases and then 1 mile per dollar spent on every thing else.

Delta SkyMiles Platinum American Express Card

So the third card in the lineup is the Delta SkyMiles Platinum American Express Card.

Now this card is quite a bit more expensive than the Gold card, as it has a $350 annual fee.

But as you will see, it does offer a lot more potential value than both the Blue and Gold card as it has a wider range of benefits and perks.

So this card is more geared towards people who frequently travel with Delta and are looking to get a wide range of benefits and perks that can provide you with quite a lot of value.

Sign-up Bonus

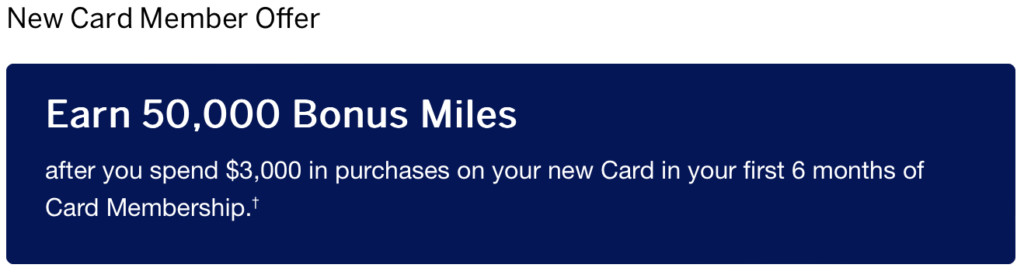

Now the sign-up bonus on offer with the Platinum card is pretty good, although it is not that much better than what the Gold card is offering.

Currently it is possible to earn 50,000 bonus miles if you manage to spend $3,000 on the card within the first 6 months of card ownership.

Thats a spend of $500 per month for 6 months to receive the sign-up bonus.

So if you know you will spend at least this much, you will defiantly receive the sign-up bonus.

And with Delta SkyMiles being worth 1.2 cents per miles, this sign- up bonus is worth approximately $600.

Benefits

Now the Delta SkyMiles Platinum card comes with quite a lot more benefits and perks than both the Gold and Blue card.

And whilst it does cost quite a bit more on annual basis, if you make use of these extra benefits you will receive a lot more value.

So the most notable and valuable benefits that comes with this card is the Annual Companion Certificate.

Basically, each year after you renew the card for the following year, you will receive a Companion Certificate.

So you will need to wait 1 full year before you can actually utilize this benefit.

And this is valid for a main cabin round trip either domestically within the US or for travel to the Caribbean or Central America.

This can potentially be worth quite a lot of money depending on when and where you fly.

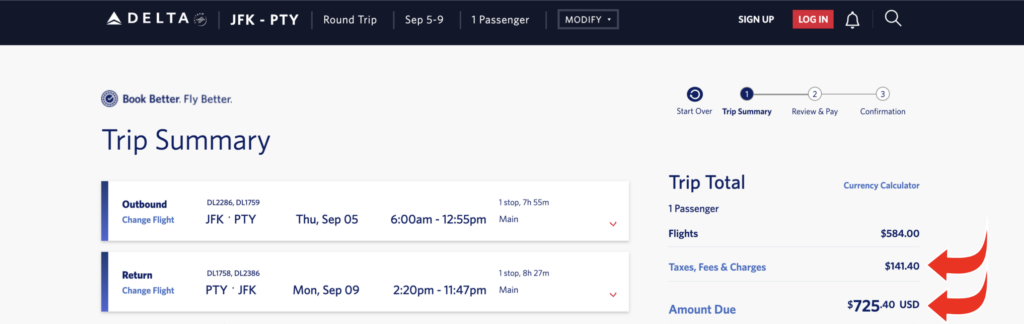

As an example, looking on the Delta website, there is a return flight from (New York, JFK) to Panama City on September 5th, returning on September 9th, flying in the Main Cabin, Class T and then class L for $725.40.

You will just have to pay $141.40 for the Taxes, Fees & Charges.

That’s really good value, and more than covers the cost of the annual fee.

Things You Must Know First

Now there are a few things you need to know about the Companion Certificate before you use it.

- It cannot be used for basic economy fares, it can only be used to book main cabin fare.

- It has to be a round trip ticket, one way tickets are not eligible for this offer.

- Also, when utilizing the Companion Certificate, you must be traveling with the main card holder on the same flight, under the same reservation.

- And finally, domestic round trips will incur taxes and fees of up to $80, and international flight will incur taxes and fess of up to $250.

Now when you do decide to utilize your Companion Certificate, there are a few restrictions.

You will only be able to make a booking through the website: delta.com/redeem.

Also, Companion Certificates can only be booked on classes L, U, T, X, and V in the Main Cabin.

For this reason, it can be a little difficult finding free flights, so I highly recommend that you book well in advance to secure your booking.

Now along with the Companion Certificate there are still a few more benefits on offer.

The first one being a $150 Delta Stays Credit.

This basically allows for a $150 credit when you make a booking throughDelta Stays on delta.com.

There is then a $120 Resy Credit that is given to you in allotments of $10 a month offer the course of the year.

This can be used towards restaurant bookings that are booked through the website Resy.com

And whilst this is a nice benefit to have, I think it would make a lot more sense to be able to utilize the full credit all in one go, as $10 a month is really not enough money to notice much of a difference on a restaurant bill.

There is then a $120 Rideshare Credit that is also provided in $10 allotments each month.

And this can be used for services such as Uber or Lyft.

You will then have the option of receiving a $100 credit that can be used for either Global Entry or TSA Precheck.

This can sometimes be a useful benefit to have, but in recent years I have found that both Global Entry and TSA Precheck are almost just as busy as the regular security clearance options.

Now an another benefit that is included with this card is the MQD Headstart.

With this you will receive $2,500 Medallion Qualification Dollars each Medallion Qualification Year.

Along with this you will also be able to earn $1 Medallion Qualification Dollar per $20 spent on the card.

This should help to bring you a little bit closer to Medallion status over time.

There is also access to Hertz Five Star Status, and I guess this is useful if you hire cars from Hertz.

I personally just use Turo, as it has a wider range of cars for a better price.

As a Platinum card holder you will also be eligible to be placed on a Complimentary Upgrade List.

And then just like the Gold card you also get the following benefits:

- 20% back on in flight purchases

- TakeOff 15

- Priority Boarding

- Your first checked bag free

- And the ability to receive $50 off the cost of your flight for every 5,000 miles you redeem through Pay with Miles.

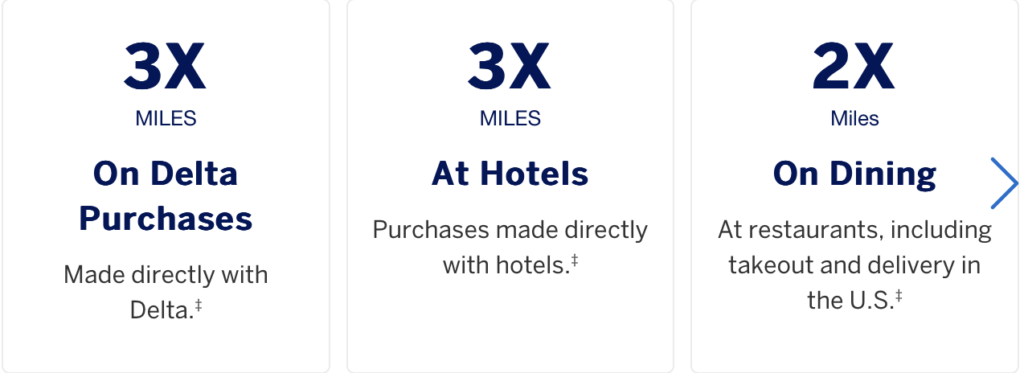

Earning Miles

Now when it comes to earning miles, the Amex Delta SkyMiles Platinum card offers quite a lot more potential to earn miles than both the Blue and Gold card.

Specifically as it has higher miles earning categories and a wider range or options to choose from.

So you will be able to earn 3x miles for any purchases that are made directly with Delta.

Along with this, any direct hotel booking that are made with the card will also receive 3x miles.

There is the same 2x miles earrings as the Gold card for purchases made at US supermarkets and on dining from within the US.

Then all other purchases made on the card will earn you 1 miles per dollar spent.

Delta SkyMiles Reserve American Express Card

So the last card on the list and the most exclusive card is the Delta SkyMiles Reserve American Express Card.

And you might have guessed it is quite a bit more expensive than all of the other cards on offer.

Basically it has an annual fee of $650, which is really quite expense.

But it does come with seem pretty valuable benefits as you will soon see.

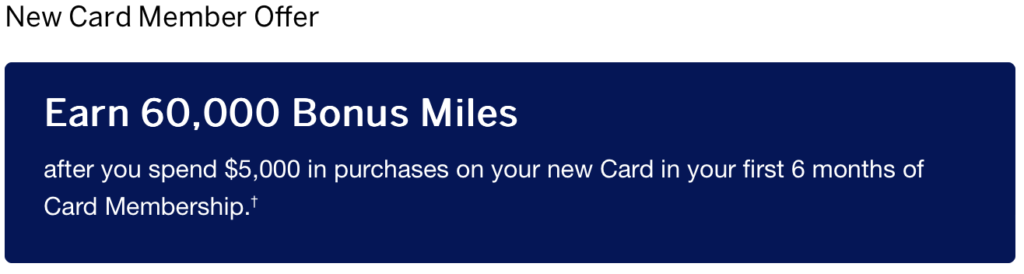

Sign-up bonus

So given the substantial price increase for the annual fee, you might expect to get a much better sign-up bonus, but thats not the case.

At the time of making this video the current sign-up bonus is 60,000 bonus miles after you manage to spend $5,000 on the card within the first 6 months of card ownership.

Thats a spend of just over $830 each month for 6 months to receive the sign-up bonus.

And with Delta SkyMiles being valued at around 1.2 cents per mile, this signup bonus is worth approximately $720.

So its not a bad sign-up bonus, but not much more than what you get from the Delta SkyMiles Platinum card.

Benefits

Now in terms of benefits, the Delta SkyMiles Reserve American Express Card does offer some pretty impressive benefits, as you would expect for a card that cost $650 a year.

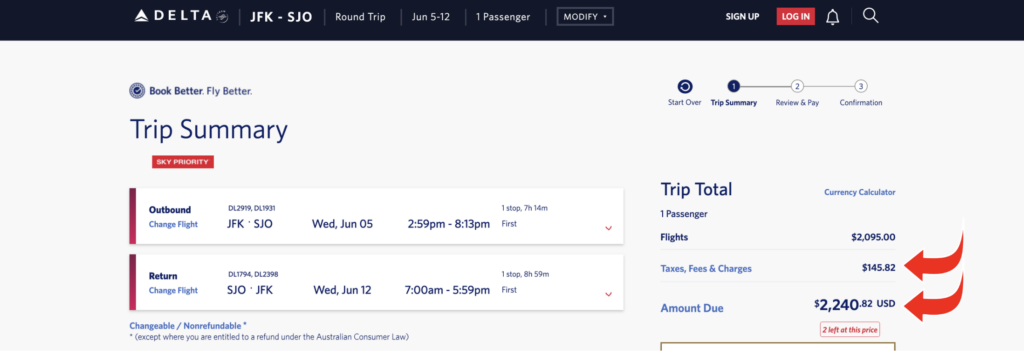

And the most valuable benefits on offer is the Annual Companion Certificate, and the main difference with this over the Platinum cards Annual Companion Certificate is that it can be also be used for First class or Delta Comfort+.

This can potentially be worth literally thousands of dollars depending on when and where you fly.

As an example, looking on the Delta Website there is a round trip from NYC (JFK) to San Jose Costa Rica, on June 5th- 12th for $2,240.82.

You will just need to pay $145.82 for Taxes, Fees & Charges.

And this is in L class, which is a requirement to make a booking in First Class using a Companion Certificate.

Now just like the Companion Certificate with the Platinum card there are similar restriction in place which are:

- It cannot be used for basic economy fares, it can only be used to book a First class, Delta Comfort+ or main cabin fares.

- It must be a round trip ticket as one way tickets are not eligible for this offer.

- You must be traveling with the main card holder on the same flight, under the same reservation.

- And domestic round trips will incur taxes and fees of up to $80, and international flight will incur taxes and fess of up to $250.

Now another benefit that only comes with the Reserve card is lounge access to both the Delta Sky Club and the Centurion Lounge.

With the Delta Sky Club (at least from next year – 2025) you will be provided with 15 visits each year.

But if you are flying on Basic Economy, you will not be allowed access to the lounge.

If you want to visit more than this you will need to spend $75,000 on the card within the year, this will then allow for unlimited visits for the remainder of the year.

Then with the Centurion Lounge you will have access as a card member, and you will also have the ability to bring along 2 guests, but it will costs $50 per guest.

And it’s worth noting that to gain access to either of these lounges, you must be flying on a same day Delta flight.

Now along with the Companion Certificate and Lounge access, there are a few other perks and benefits worth mentioning.

The first being a $200 Delta Stays credit, this is $80 more than what you get with the Platinum card.

- Then there is a $240 Resy credit which is provided in $20 allotments each month, so twice as much as what the Platinum card is offering.

- There is the same $120 Rideshare credit that is provide to you in $10 allotments each month.

- The same $100 credit for Global Entry or TSA Precheck.

- You will also be eligible for the Complimentary Upgrade List.

- There is the $2,500 Medallion Qualification Dollars each Medallion Qualification Year.

- And you will be able to earn able to earn $1 Medallion Qualification Dollar per $10 spent on the Reserve card, as apposed to the Platinum cards required spend of $20.

- There is access to Hertz President’s Circle Status which is the next level up from Hertz Five Star Status.

And finally, just like the Gold and Platinum card you also receive the following benefits:

- 20% back on in flight purchases

- TakeOff 15

- Priority Boarding

- Your first checked bag free

- And the ability to receive $50 off the cost of your flight for every 5,000 miles you redeem through Pay with Miles

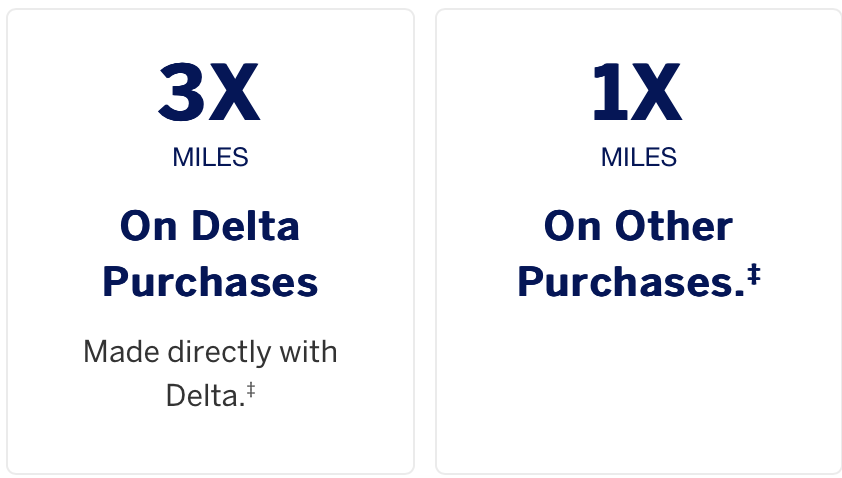

Earning Miles

So the last thing to look at is the Miles earning ability of the Reserve card, and for some bizarre reason it is more limited than what you receive from the Platinum card.

Basically it is possible to receive 3x Miles for purchases made directly through Delta.

Then all other purchases will earn you just 1 miles per dollar spent.

I find this a bit bizarre that Delta and Amex would limit your ability earn miles from their top tier card.

You would have thought they would want to reward you for spending more money on the card, as that is one of the ways they actually make money from their credit cards.

Final Thoughts

So there you have it, that pretty much everything you need to know about all four of the Amex Delta SkyMiles credit cards.

And as you can see, if you spend more for a particular card, you will receive more benefits .

But I must say that the higher tiers cards, such as the Platinum and Reserve card are almost like a glorified coupon book of benefits.

And this is because you are already paying for a majority of the benefits via the high annual fees.

If I had to pick one of these cards, I would personally go for the Delta SkyMiles Platinum card, as it has a much better miles earning potential than all of the other cards.

It is also substantially cheaper than the Reserve card on an annual basis.

And to make up for the lack of lounge access, I would just use this link here to save up to $118 off a Priority Pass Membership.