by Daniel | Last Updated July 14th, 2023

We may earn a commission for purchases using our links, at no cost to you.

In this article, I’m going to review and compare both the Amex Green card and the Chase Sapphire Preferred card to see which card offers the most value and which one might be the best choice for you.

Who Are These Cards Good For?

So before I get into the finer details about both of these cards it’s worth considering if either one will be a good fit for you and your spending habits.

The first thing to know is that most of the value on offer with both of these cards is travel related.

This includes points earning potential, benefits, and insurance-related coverage.

Also, both cards have an annual fee, with the cheapest of the two cards, the Chase Sapphire Preferred card it will cost you $95 per year.

Then with the American Express Green card, you are looking at an annual fee of $150 or $55 more than what the Chase Sapphire Preferred card costs.

Now thankfully it is really quite easy to make up for this cost just by taking advantage of some of the benefits on offer, which I will talk you through later in this video.

What Is The Signup Bonus Worth?

So a question that pretty much everyone has is ‘How much is the sign-up bonus worth?’

Well, at the time of making this video, with the Chase Sapphire Preferred card it is possible to earn 60,000 bonus points after you spend $4,000 on purchases within the first 3 months of opening the account.

And seeing that Chase Sapphire Preferred points are worth 1.25 cents per point when redeemed through Chase Ultimate Rewards, this sign-up bonus is worth $750, which is almost 8 times the cost of that annual fee.

Now this is a really nice sign-up bonus and is quite valuable, but it is possible to earn quite a lot more value if you just transfer these points to one of the travel related partners.

And currently, there are 11 different airline partners and 3 hotel partners which all present a transfer value of 1:1.

So let’s just take a quick look at a couple of examples of how you can receive quite a lot more value by transferring these points.

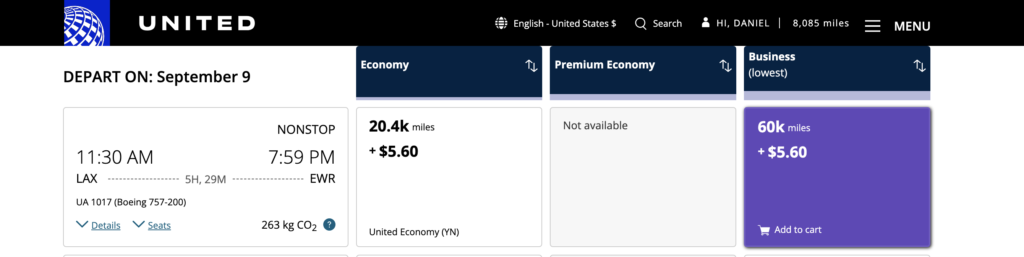

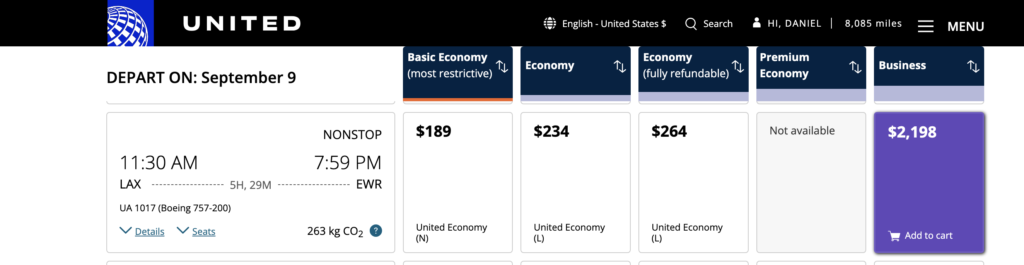

The first example is by booking a flight through Unite Airlines which is one of the travel partners, and has a transfer value low 1:1.

And have found a one-way flight from LAX to Newark traveling business class for 60,000 points (plus $5.60 in fees).

Now if you were to pay for this flight in cash it would cost you $2,198, so this provides you a value of around 3.6 cents per point which is really good!

The second example would be to transfer points to the World of Hyatt, which also has a transfer value of 1:1.

Here I have found a hotel room in NYC on the same date as the flight I just talked about at the Park Hyatt New York.

And it is possible to book 1 night there for 45,000 points.

Now if you were to pay for this hotel room in cash it would cost you $1,495!

So this provides you with a value of around 3.3 cents per point, which again is really good!

Now with the American Express Green card, it is possible to earn 60,000 Membership Reward Points after you spend just $3,000 on purchases within the first 6 months of opening the account.

And the big difference here is that you only need to spend $3,000 not $4,000 like the Chase Card, you will also have twice the amount of time to meet the spend requirement.

So the Amex Green card makes it a lot easier to receive the sign-up bonus.

Now along with this, it is also possible to earn 20% Back on Eligible Travel and Transit up to a total of $200 back in the way of a statement credit during the first 6 months of card ownership.

And this covers a large category of items which include:

- Taxi or ride-share

- Subway or buses

- Hotels and car rentals

Now seeing that Amex points are worth up to 1 cent per point, the 60,000 points are worth $600, and then assuming you receive the maximum of $200 back from travel and transit within the first 6 months of card ownership, you are looking at a value of $800.

This is just over 5 times the cost of the annual fee.

So similar to the Chase Sapphire Preferred card, it is possible to earn more value from your points by simply transferring them to one of the travel partners.

And currently, there are 17 different airline partners and 3 hotel partners, with most partners offering a value of 1:1, although Hilton Honors offers a value of 1:2.

So let’s just take a quick look at a couple of examples of how you can receive more value by transferring these points.

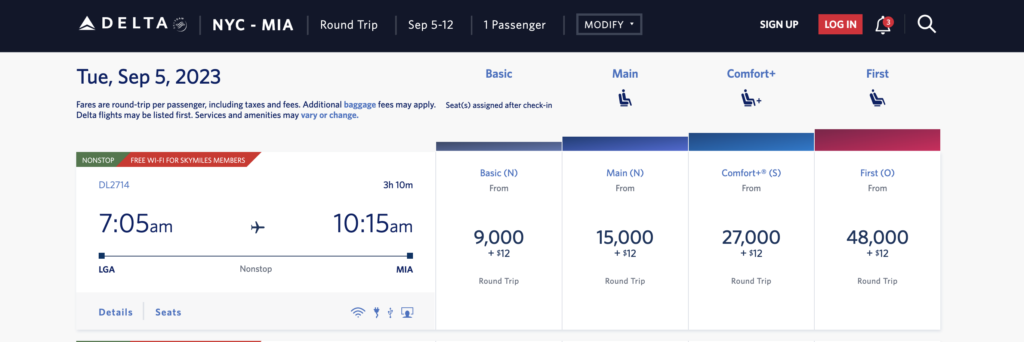

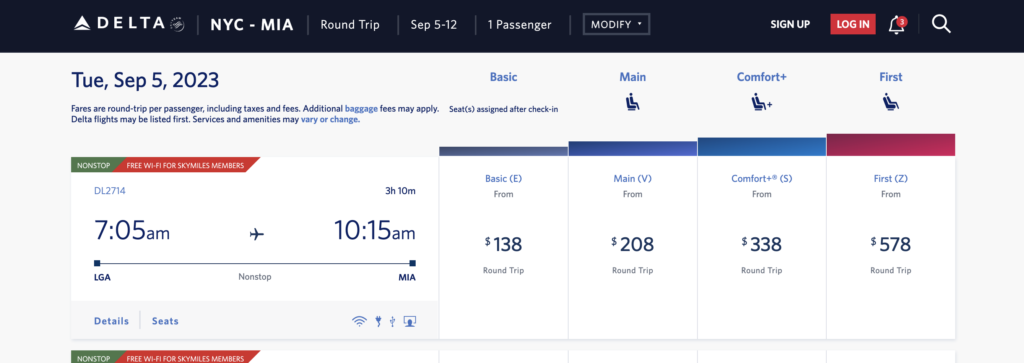

The first example is by booking a flight through Delta which is one of the travel partners and has a transfer value of 1:1, and I have been able to find a return flight from LaGuardia to Miami for just 9,000 Miles plus a $12 fee.

Now if you were to pay cash for this flight it would cost you $138,

This works out to be a point value of 1.4 cents per point after taking the $12 fee into account.

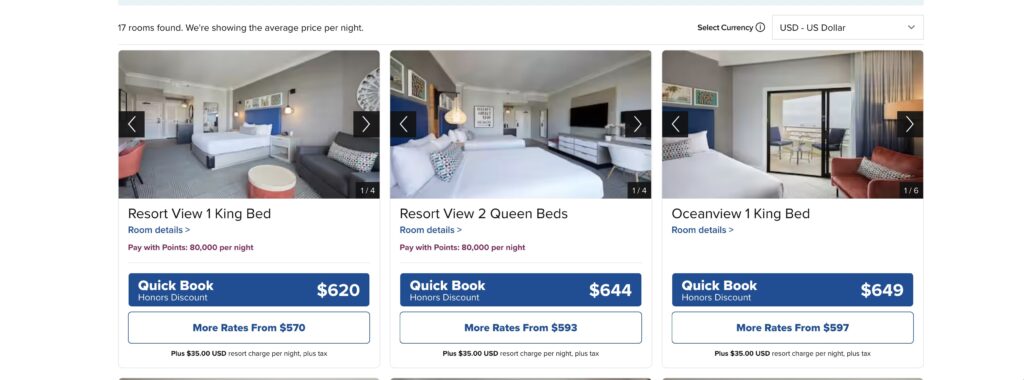

The second example would be to transfer points to Hilton Honors which has a transfer value of 1:2.

And I found a room at The Waterfront Beach Resort at Huntington Beach that can be booked for 80,000 Hilton points per night, which at a 1:2 transfer ratio equals just 40,000 Membership Rewards Points.

Now if you were to pay for this room in cash it would cost you $620, so this presents a points value of just over 1.5 cents per point which is 50% more than what you would receive by booking directly through Amex.

So as you can see it is quite easy to find valuable deals just by spending a little bit of time researching through some of the available travel partners.

Benefits And Perks Of Each Card

Now besides the fact that both of these cards offer a generous sign-up bonus, they also come with some nice benefits and perks that provide you with even more value.

So with the Chase Sapphire Preferred card, it is possible to earn a $50 statement credit each year for any hotel bookings that you make through Chase Ultimate Rewards.

This helps to lower the annual fee down to just $45.

Another nice benefit that comes with this card each year is the ability to receive 10% of your total annual spend back in the way of bonus points.

So if you were to spend $20,000 over the course of the year, Chase would credit your account with 2,000 points.

Then finally there are a few partner benefits that include:

- A complimentary 12-month DashPass Subscription that has a value of $96.

- A complimentary 6-month Instacart+ membership that is worth approximately $50 which also comes with a $15 statement credit each quarter.

- A $10 monthly statement credit from Gopuff.

Now with the American Express Green card, you actually get a bit more in the way of benefits which makes sense as it is $55 more per year.

First of all, you will receive a $189 credit that can go towards paying for a CLEAR Plus membership which usually costs $189 per year.

This basically helps to get you through airport security a little quicker than normal.

Then finally there is a $100 LoungeBuddy credit which is accessible from either the LoungeBuddy website or the LoungeBuddy app.

This basically provides you credit of up to $100 for any airport lounge that you pay for on their website.

How Can You Earn Points?

So now let’s look at the ability each card has to earn points.

And you will see that both cards offer quite a decent range of categories to earn points from.

Starting with the Chase Sapphire Preferred Card it is possible to earn points from the following categories:

- 5x points on travel-related purchases that are made through Chase Ultimate Rewards and on Lyft rides

- 3x points at restaurants, eligible delivery services, takeout, online grocery purchases, and on select streaming services

- Then all other purchases will earn you 1 point per dollar spent

Now with the American Express Green card, you actually get a fair bit more in the way of benefits which makes sense as it is $55 more per year.

- 3x points on travel, transit, and dining at restaurants

- Then all other purchases will earn you 1 point per dollar spent

So the Chase Sapphire Preferred card offers you the ability to earn more points that are worth slightly more from similar purchase-related categories.

Insurance Related Benefits

Now if you do happen to have one of these cards, or decide to get one, it’s worth knowing what type of insurance coverage you have access to.

So both cards come with Auto Rental Insurance.

With the Amex Green card, it is secondary coverage and covers up to $50,000.

Then with the Chase Sapphire Preferred card, the coverage is primary insurance and provides reimbursement up to the cash value of most vehicles for theft and collision damage.

There is Trip Delay Insurance offered with both cards.

The Amex Green card provides you with up to $300 per trip if it is delayed for more than 12 hours, and it is possible to make up to 2 claims in a 12-month period.

With the Chase Sapphire Preferred card, it is possible to receive up to $200 more for a total of $500 per ticket for you and your family if your travel happens to be delayed for more than 12 hours.

Both cards offer an Extended Warranty, with the Amex Green card you will receive 1 additional year of coverage on warranties that are 5 years or less.

Then with the Case Sapphire Preferred card, you will receive 1 additional year of coverage on warranties that are 3 years or less.

There is Purchase Protection offered with both cards.

With the Amex Green card, you will receive up to 90 days of coverage on new purchases that are either accidentally damaged or stolen, and this covers up to $1,000 per occurrence and a total of $50,000 per year,

Then with the Chase Sapphire Preferred card, you will receive 120 days of coverage against damage or theft.

And this provides you with up to $500 per claim and a total of $50,000 per account.

Only the Amex Green card offers a Baggage Insurance Plan which covers you for up to $1,250 for carry-on luggage and $500 for checked baggage if it happens to be damaged or lost.

Then only the Chase Sapphire Preferred card offers the following coverage:

- Baggage Delay Insurance which covers up to $100 per day for up to 5 days if your luggage happens to be delayed for more than 6 hours by a passenger carrier.

- Trip Cancellation/Interruption Insurance which covers up to $10,000 per person and $20,000 per trip.

Final Thoughts

Ok so that covers pretty much everything these cards have to offer and as you can see they are really quite similar.

If you compare these cards by the benefits that are on offer, the Chase Sapphire Preferred card offers you $230 in value, which comes from the following benefits:

- A $50 statement credit for hotel bookings

- $120 in GoPuff credits

- $60 in Instacart+ credits

So if you take the $95 annual fee away for this you are left with $135 in value.

Then with the Amex Green card, the total value on offer works out to be $289, this comes from the following benefits:

- A $189 CLEAR Plus membership

- $100 LoungeBuddy credit.

Then if you subtract the $150 annual fee away for this you are left with $139 in value.

So technically speaking the Amex Green card provides you with a little bit more value than the Chase Sapphire Preferred card,($4 more to be precise) but does this mean it is the best card?

Well, this depends on a few factors, specifically what benefits you will actually use with each card.

With the Amex Green card If you know you will travel enough to get value from the $189 CLEAR Plus credit and $100 LoungeBuddy credit then it might be the obvious choice to choose this card.

But in my experience with using CLEAR Plus, it really hasn’t made much of a difference if any to the amount of time I actually save getting through Security when I am at the airport.

Although maybe this is just bad luck on my part,

With the Chase Sapphire Preferred card I honestly believe that it is slightly easier to make use of the credits that are offered as spending $10 a month of GoPuff is super easy, and receiving the $50 credit for hotel stays is also relatively easy to utilize.

In terms of earning points the Chase Sapphire Preferred card has the ability to earn more points but the only thing that can be a bit difficult is the fact that earning 5x points for travel can only be obtained by booking through Chase Ultimate Rewards.

With the Amex Green card, although you only receive 3x points from travel, it is much easier to actually earn the points for travel as you are not restricted to booking through one portal like the Chase Sapphire Preferred card is.

Then in terms of insurance-related coverage both cards are really quite similar in what they offer.

So where does that leave us choosing the best card?

Well, like I said before it really comes down to which benefits you will actually use.

If the benefits on offer with the Amex Green card sound better to you, then that would be the best card for you to choose.

And the same goes for the Chase Sapphire Preferred card.

I personally like both of these cards and would recommend either one.

I’ve had Amex cards and Chase cards now for the past 10 years and have been perfectly happy with both companies.

Now if you enjoyed this article make sure to check out this video here where I reveal The Ultimate Credit Card For 2023.