by Daniel | Last Updated Nov 29th, 2022

We may earn a commission for purchases using our links, at no cost to you.

If you’re looking for a credit card that offers a 0% intro APR and also has some decent benefits and user perks, then any of the 3 credit cards in this review are worth considering.

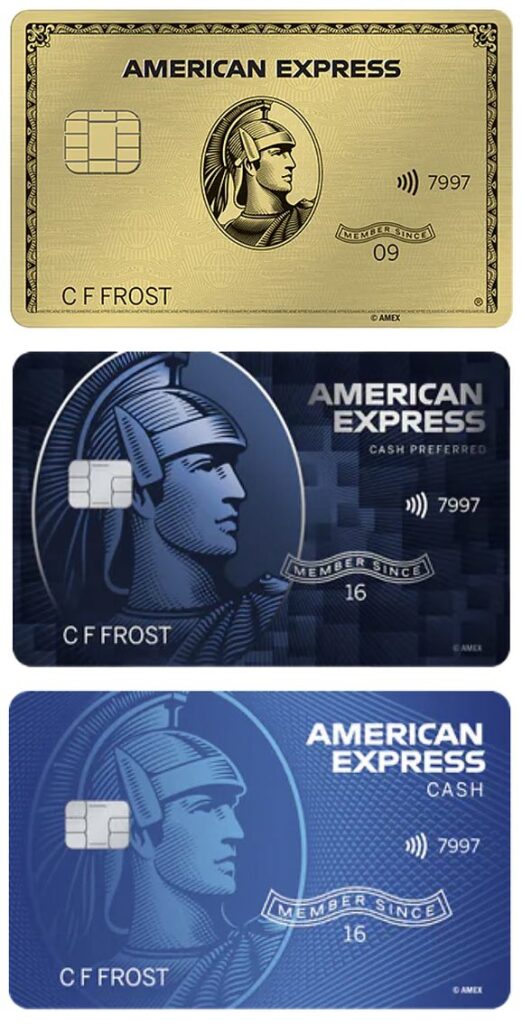

In this article, I’ll talk about the American Express Gold Card, the Amex Blue Cash Preferred Card, and the Amex Cash Magnet card.

Who are these cards these good for?

Now seeing that all there of these cards are all slightly different, it makes sense to go over what benefits and perks come with each card to decide which one will be a good fit for you.

With the Amex Gold card, which has an annual fee of $250, there is a focus on food-related benefits which come in the way of a $120 dining credit and $120 in Uber cash which can be used for Uber eats or Uber rides.

There is also a $100 credit for bookings of 2 nights or more that are made through The Hotel collection.

And this credit can be used for food-related benefits at the hotel during your stay.

The signup bonus is currently 60,000 Membership Rewards Points if you manage to spend $4,000 on purchases within the first 6 months of opening the account.

And this is worth at least $600 if you redeem the points for travel that is booked through American Express Travel.

Now along with this, it is also possible to earn 4x points at restaurants word wide, which also includes take out and delivery from within the US.

Then each calendar year it is possible to earn 4x points at US supermarkets up to a total spend of $25,000.

Flights that are booked directly with airlines or on amextravel.com will then earn 3x points.

And all other purchases will earn 1 point per dollar spent.

So as you can see the Amex Gold card is a great all-around card that gives you the ability to earn a lot of membership reward points for food-related purchases.

And by taking advantage of both the $120 dining credit and $120 in Uber cash, the annual fee comes down to just $10.

Now the American Express Blue Cash Preferred Card is a cash-back card that offers the ability to earn up to 6% cash back at U.S. supermarkets up to a total of $6,000 each year.

There is also 6% cash back on U.S. streaming subscriptions.

Purchases made on Transit and at U.S. gas stations will earn 3% cash-back.

And then all other purchases will earn 1% cash-back.

Now along with this the card also offers an $84 credit that can be used on The Disney Bundle, and a $120 Equinox+ Credit, which more than covers the $95 annual fee when it kicks in after the first year, which is free.

There is also a signup bonus which offers $250 in the form of a statement credit if you manage to spend $3,000 on the card within the first 6 months of card ownership.

So the American Express Blue Cash Preferred Card is a great card if you don’t want to spend a fortune on the annual fee of a credit card.

It also offers the ability to earn quite a decent amount of cash back through everyday purchases that are made on the card.

Now with the Amex Cash Magnet Card there isn’t as much on offer as both of the other cards, but to be fair there is no annual fee.

One nice feature of the card is the ability to earn unlimited 1.5% Cash Back on all purchases.

Also, if you are able to spend $2,000 on the card within the first 6 months of opening the account, it is possible to revive $200 back in the way of a statement credit

So it’s a great affordable cash-back card that also has a very useful intro APR which I will talk about in the next section of this review.

What intro APR does each card offer?

Now each of these cards actually has a slightly different introductory APR offer, so lets take a look at how each card compares.

So starting first with the Amex Gold card it is possible to receive a 0% Intro APR on eligible charges for the first 6 months of card ownership. Basically, this covers purchases that are eligible for Pay Over Time, which includes:

Any new Purchases and any associated foreign transaction fees.

Now if you chose to take advantage of this 0% intro APR, it will be available from the day your card is approved until the promotional period up, which for this card is 6 months.

With the American Express Blue Cash Preferred Card, there is a 0% intro APR that runs for 12 months.

This is available for purchases and balance transfers.

If you want to take advantage of a Balance Transfer you must request it within 60 days of account opening.

And the limit for a Balance Transfer with this card is capped at $7,500, also any Balance Transfer must be greater than $100.

Now with the American Express Cash Magnet Card the 0% Intro APR is available for 15 months and covers both purchases and balance transfers.

Just like the Amex Blue Cash Preferred card, any balance transfers must be requested within 60 days of opening the account.

Should you get a Balance Transfer?

So both the Amex Blue Cash Preferred card and the Cash Magnet card both offer the ability to receive a 0% intro APR for balance transfers.

Now if you are considering taking advantage of a Balance Transfer it is worth understanding how one works and what fees and charges might be included.

One of the main benefits of a 0% intro APR is that you can borrow money at an extremely low-interest rate, which in this case would be 0%.

And this can be really useful if you currently have debt in another account that is charging a really high-interest rate.

Basically, it gives you to option to save quite a lot of money.

Also, be aware that even though it is a 0% APR, there will be a fee if you do get a balance transfer with both of these cards, which will be either $5 or 3% of the amount of each transfer, basically whichever amount ends up being more.

So for example, if you were to do a balance transfer of $5,000 the 3% fee ends up being $150.

And finally, if for any reason you make a late payment on the amount you owe it would not be unusual for Amex to take you off the 0% Intro APR and put you on a Penalty APR of 29.99%, which can really start to add up if you owe a decent amount of money.

There will also be a fee of up to $40 if this happens.

So just make sure to be consistent with your payments if you do decide to get a balance transfer to avoid any unwanted fees.

Insurance coverage

Now all of these cards come with some pretty decent insurance related coverage, which can be quite valuable if you do ever need to use it.And as you might expect, the more expensive Gold card offers a fair bit more than the other two cards.

So all 3 cards offer Car Rental Loss and Damage Insurance up to a total value of $50,000 in the event of any damage or theft or a rental vehicle, and this is secondary coverage.

Then all 3 cards also offer Purchase Protection although the Gold card offers a higher limit.

Basically, the Amex Blue Cash Preferred card and the Amex Cash Magnet card offers 90 days of coverage with up to $1,000 per covered purchase and a total of $50,000 each year.

Whereas the Amex Gold card offers the same 90 days of coverage but up to $10,000 per covered purchase and then the same $50,000 each year.

Both the Amex Gold card and the Amex Blue Cash Preferred card offer Extended Warranty protection which basically provides you with one extra year of coverage on Warranties that are 5 years or less.

Now just the Amex Blue Cash Preferred card offers Return Protection.

This basically covers you for up to 90 days for any purchases that a seller won’t take back, and coverage is for up to $300 per item with a maximum of $1,000 each year.

Then just the Amex Gold card provides a Baggage Insurance Plan which covers check baggage for up to $500 and carry-on luggage for up to $1,250

Final Thoughts

So there you have, that pretty much covers everything there is to know about these three credit cards.

And in my opinion, each card offer quite a decent amount of value.

If your main reason for choosing one of these cards is to get a Balance Transfer then either the American Express Blue Cash Preferred Card or the Amex Cash Magnet Card are the cards to choose.

With the Amex Blue Cash Preferred Card offering a 0% intro APR of 12 months and then the Amex Cash Magnet Card offering 15 months, either card should be able to help you out.

Now If you’re looking for the most benefits and user perks with the ability to earn a ton of Membership reward points from everyday spending, then the Amex Gold card is the card to get.

Its $250 annual fee is almost totally covered by taking advantage of the $120 dining credit and $120 in Uber cash.

And then the sign-up bonus of 60,000 Membership rewards points is worth at least $600.

Now if you do need a balance transfer and want to learn more about what getting one entails, check out this article here where I talk you through all the ins and outs of getting a Balance Transfer .