by Daniel | Last Updated January 28th, 2022

We may earn a commission for purchases using our links, at no cost to you.

If you travel for work or leisure and are looking for a way to earn free travel with a credit card then the United MileagePlus credit cards are worth considering.

United Airlines is one of the largest airlines in the world, and its MileagePlus program is a great way to earn and redeem miles that can then be used for free travel.

In this article, I will go over every aspect of all four of the United MileagePlus credit cards to help you make an informed decision on which card is best for you.

And then at the end of the article, I’ll give you my opinion on which card I would choose and why.

Who are these cards good for?

All four of the United MileagePlus Credit cards are perfect for anyone that frequently flies with United Airlines or any of its partners, as that is where a majority of the benefits are focused.

And best of all there is a card for everyone, with the most affordable United Gateway Card having no annual fee at all, all the way up to the most exclusive card on this list, the United Club Infinite Card costing $525 a year.

Sign-up Bonus

Now all four of these credit cards offer a reasonable sign-up bonus that quite easily covers the cost of the annual fee, and as you would expect the more exclusive and expensive cards offer the largest bonus.

And currently, United MileagePlus miles are worth 1.2 cents per mile.

So starting with the entry-level United Gateway card it is possible to earn 20,000 bonus miles after you spend $1,000 on purchases within the first 3 months of card ownership.

So this sign-up bonus is worth $240

Now with the United Explorer card is it possible to earn 50,000 bonus miles if you can manage to spend $3,000 on the card within the first 3 months of card ownership.

And these 50,000 miles are worth $600, which is more than twice the value of what the Gateway card is offering.

Next up with the United Quest card it is possible to earn 60,000 bonus miles after spending $4,000 on the card within the first 6 months of card ownership.

So this sign-up bonus is worth $720.

And finally, the United Club Infinite card is offering 80,000 bonus miles after you spend $5,000 on the card within the first 3 months of card ownership.

So this sign-up bonus is worth $960.

Annual Fee

Now as I just mentioned before the entry-level card from United is free on an annual basis, so it doesn’t need to be expensive to have one of these cards and start earning miles.

So let’s just take a quick look at what each of these cards costs on an annual basis.

Now the entry-level United Gateway Card has no annual fee, so if you are limited in your budget it is a great card to start with.

It offers the ability to earn a sign-up bonus and miles when spending on everyday purchases, which is something will get into later in the video.

The next card on the list is the United Explorer Card which initially is free for the first year of card ownership, after this it will cost you $95 a year which is not too bad considering some of the benefits that come with the card.

Now the second last card on this list is the United Quest Card which has an annual fee of $250 which is starting to get a bit more expensive, but the card does come with a $125 annual United purchases credit each year which brings the annual fee down to a more reasonable $125.

Finally, the most exclusive card on this list which is the United Club Infinite Card comes with an annual fee of $525, which is more than twice the price of the Quest card.

But it does come with a lot of extra benefits and perks which I will cover later in this video.

Benefits and user Perks

Now all four of the United MileagePlus Credit Cards offer different levels of benefits depending on which card you get, obviously, the entry-level United Gateway Card has the least amount of benefits, and then the most expensive and exclusive United Club Infinite Card has the most to offer.

So let’s take a closer look at what you get with each card.

Starting first with the United Gateway Card there are only a few benefits that come with this card.

The first is the ability to receive a 25% discount on any purchases of food, drinks, or Wifi that are made on a United flight.

Basically, this is provided in the way of a statement credit to your account.

Then there is a complimentary 12-month DashPass which provides you with free delivery on orders that are more than $12, and this benefit is worth $96.

As a cardholder, there is access to The Luxury Hotel & Resort Collection which is a collection of over 1,000 different properties from all over the world, and when making a booking using the Gateway card it is possible to receive the following benefits at most hotels:

- Daily breakfast for 2

- A hotel credit worth $100

- And then the ability to check in early and check out late if there is availability.

And finally, there is access to the Visa Concierge Service which is available 24 hours a day.

Here it is possible to get help with l sorts of things, from making dinner reservations, booking tickets to a sporting event, or even just finding and sending a gift to a friend.

Now with the United Explorer card one of the more notable benefits is the fact that you will receive 2 United Club one-time passes each year, and seeing that it costs $59 per person to access the club, this benefit is worth $118

Along with this, there is a $100 credit that can be used for either TSA PreCheck, Global Entry, or Nexus.

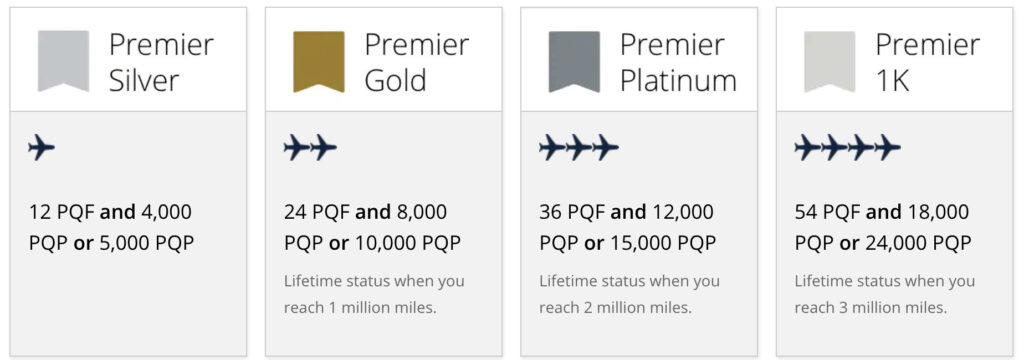

It is then possible to earn up to 1,000 Premier qualifying points each year.

Basically, for every $12,000 spent on the card, it is possible to earn 500 PQPs.

A nice additional benefit of this card that the Gateway card doesn’t offer is Priority boarding on United flights.

Along with this, your first checked bag will be free for you and one companion that is flying on the same flight.

Then just like the United Gateway Card, there is also the same 12-month DashPass, access to the Luxury Hotel & Resort Collection, and the ability to receive 25% back from inflight purchases made on United flights.

So the Explorer card offers an additional $218 in value over the Gateway card, and the ability to actually earn PQPs.

Now with the slightly more expensive United Quest card, there is quite a bit more value to be had.

Each year it is possible to earn a $125 statement credit for any United purchases that are made to the card, so just this one benefit brings the annual fee down to a more reasonable $125.

There is then the ability to earn 5,000 miles back after you take a United-operated flight, and this can be received 2 times per anniversary year.

And seeing that United Miles are worth 1.2 cents per mile this benefit is worth $120.

Then when flying on any United-operated flights it is possible to receive both your first and second bags checked in for free, and this is available for you and one travel companion.

For every $12,000 spent on the card, it is possible to earn 500 PQP’s up to a total of 6,000 PQPs in a calendar year.

Then just like the Explorer card, you get the following benefits:

- A 12-month DashPass

- 25% back for inflight United purchases

- A $100 credit for use at TSA PreCheck, Global Entry, or NEXUS

- Priority Boarding on United Flights

- Access to the Luxury Hotel & Resort Collection

Now finally with the most expensive and exclusive card on the list, the United Club Infinite Card there are quite a lot of benefits on offer.

The most notable benefit is a United Club membership which is worth $650 each year.

Just this benefit alone covers the cost of the $525 annual fee and leaves you $125 to spare.

Currently, there are 45 different United Club locations that you will have full access to.

Along with this, it is also possible to visit over 1,000 Star Alliance Lounge from all over the world.

The United Club provides a whole range of complimentary food, beverages, and space to get work done when you’re traveling.

A nice benefit that only comes with this card is Premier Access travel services which basically provides you with priority check-in, baggage handling, and boarding.

Similar to the Explorer card it is possible to earn 500 PQPs for every $12,000 that is spent on the card with a maximum of 8,000 PQPs in a calendar year, which is 2,000 more than what the Explorer card allows you to earn.

For any United Economy Saver award tickets within the continental US or to Canada, it is possible to receive a 10% discount.

Another exclusive benefit that only comes with this card is IHG Rewards Platinum Elite status.

Along with this, it is possible to receive up to $75 in statement credits for any IHG hotel bookings that are made to your card.

And finally, just like the Explorer card, you get the following benefits as well:

- A 12-month DashPass

- 25% back for inflight United purchases

- A $100 credit for use at TSA, PreCheck, Global Entry, or NEXUS.

- Priority Boarding on United Flights

- Access to the Luxury Hotel & Resort Collection

Earning Miles

Now when It comes to earning miles all of these cards offer a variety of ways to earn miles from a few different categories.

Starting with the United Gateway card it is possible to earn 2x miles on United Purchases and then 2x miles on gas, local transit, and commuting.

Then with the United Explorer card, the miles-earning options are slightly different.

Basically, it is possible to earn the same 2x miles on United purchases and 2x miles for purchases made on dining and hotels.

Now with the United Quest card, it is possible to earn slightly more miles than with the Gateway card.

Basically, United purchases will earn 3x miles per dollar spent.

And then it is possible to earn 2x miles on dining, select streaming services, and all other travel.

Finally, with the United Club Infinite card, it is possible to earn 4x miles on United purchases, and this is pretty good, especially if you do fly quite often, specifically with United.

Then dining and all other travel-related purchases will earn 2x miles.

Insurance Coverage

Now all of these cards offer a decent amount of travel-related insurance, and as expected, the more expensive the card, the more coverage you can receive.

So starting first with the entry-level United Gateway Card there is Trip Cancellation / Trip Interruption Insurance that provides up to $1,500 per person and $6,000 per trip if your trip happens to get canceled or cut short.

There is then an Auto Rental Collision Damage Waiver that helps to protect you against theft or collision damage to a rental card, and this is secondary coverage.

With Purchase Protection it is possible to receive up to 120 days of coverage against theft or damage of new purchases up to $500 per claim and $50k per account.

And finally, there is Extended Warranty Protection that provides you with 1 extra year of coverage on warranties that are 3 years or less.

Now with the United Explore card, there is exactly the

Same Trip Cancellation / Trip Interruption Insurance and the same Extended Warranty Protection.

Then with the Auto Rental Collision Damage Waiver, the coverage is actually primary coverage.

Then a few extra things that come with this card and not the Gateway card is:

Baggage Delay Insurance of up to $100 a day for up to 3 days if your baggage is delayed for more than 6 hours.

Lost Luggage Reimbursement of up to $3,000 for you or an immediate family member that is traveling on the same flight as you.

And this covers checked or carry-on luggage that is damaged or lost by the carrier.

And finally, Trip Delay Reimbursement of up to $500 per ticket if you are delayed for more than 12 hours or require an overnight stay.

Next up, with the United Quest Card, there is the same coverage as the United Explorer card in the following categories:

- Trip Cancellation / Trip Interruption Insurance

- Extended Warranty Protection

- Lost Luggage Reimbursement

- Baggage Delay Insurance

- Trip Delay Reimbursement

- Auto Rental Collision Damage Waiver Primary

The only extra coverage that comes with this card is Purchase Protection. This provides you with 120 days of coverage for new purchases against damage or theft, and coverage is up to $10k per claim and $50k per year

Now with the United Club Infinite card the Trip Cancellation / Trip Interruption Insurance actually covers up to $10,000 per person and a total of $20k per trip, this is substantially more than all the other cards on this list.

Another benefit that only comes with this card is Return Protection.

This covers you for up to 90 days for items that a store won’t accept back and provides up to $500 per item and a total of $1,000 per year.

Then the following coverage is the same as the United Quest Card:

- Baggage Delay Insurance

- Lost Luggage Reimbursement

- Trip Delay Reimbursement

- Auto Rental Collision Damage Waiver

- Purchase Protection

- Extended Warranty Protection

APR

So all of the United MileagePlus credit cards have the same fees and APR which are as follows:

The APR for purchases and balance transfers is currently 20.74%-27.74%.

With a balance transfer incurring a fee of either $5 or 5% of the amount of each transfer.

A cash advance will carry an APR of 29.24% and will also incur a fee of either $10 or 5% of the amount of each advance.

Then the penalty APR is the usual 29.99% and will also incur a fee of up to $40 if it is caused by either a late payment or returned payment from your bank.

The only difference is that the United Gateway card has a 0% intro APR for 12 months.

Final Thoughts

So there you have, that pretty much covers everything there is to know about all 4 of the United MileagePlus credit cards.

And I think that all of the cards offer a reasonable amount of value depending on what you are actually looking for in a travel credit card.

If you don’t travel a huge amount and have somewhat of a limited budget the United Gateway Card is a great starting point.

It comes with a decent miles earning structure, a few nice benefits that can save you a bit of cash, and then there is the ability to get a balance transfer if you do need access to interest-free money.

Now in terms of mid-level cards if I had to choose between the United Explorer card or the United Quest Card I would almost certainly choose the United Quest card.

Even though it is $250 a year versus the Explorer card’s $95 annual fee (after the first year being free).

The United Quest card offers a $125 statement credit for United purchases and then up to 10,000 United miles each year which is worth $120, this brings the annual cost of the card down to just $5.

Along with this, the Quest card offers the ability to earn up to 6,000 PQP’s versus the Explorer cards’ 1,000, That’s 6x more!

It also allows for both your first and second bags checked free for you and one travel companion which can save you a substantial amount of money if you do travel quite frequently.

Now when it comes to the most expensive card of the lot, the United Club Infinite card it’s worth considering if you will use all of the benefits it offers to justify paying the $525 annual fee.

If you don’t think you will use the lounge access to the United Club of Star Alliance Lounge the card is probably not worth it.

That being said, if you do travel a lot and love access to a ton of different airport lounges, the United Club Infinite card is a great choice as just the lounge access included with this card more than offsets the annual fee of $525.

Along with that it also offers the highest miles-earning potential for United purchases and the most comprehensive insurance coverage of all 4 cards.

So if I were to choose one of these credit cards it would have to be the United Club Infinite card.

First of all, because I do travel a lot it makes sense for me to have access to airport lounges, as it really does make each trip that much more enjoyable, and just this benefit alone essentially covers the cost of the annual fee.

Along with this it also offers the highest miles earning potential of all 4 cards, specifically if you do travel with United quite often.

Now if you’re still on the fence about finding the best travel reward credit card check out my in-depth review of all four of the Amex Delta SkyMiles Credit cards.