by Daniel | Last Updated June 7th, 2021

We may earn a commission for purchases using our links, at no cost to you.

So today I am going to show you how you can easily check your annual credit report for free.

But why should you check your credit report?

Keeping an eye on your credit history and credit score can give you a better understanding of your current credit position, it will also give you a good idea of what a potential lender might see if they need to look at your credit history for a mortgage, loan or credit card application.

And finally, it will also help you see if there are any discrepancies on your credit report that you may be able to fix.

So as I said in the intro, it can be beneficial to keep an eye on your credit report, as it is the basis of how your credit score is calculated, and having a good credit score is extremely important when it comes to applying for a credit card, a mortgage or even a car loan as it can affect the loan terms and interest rate that you will pay.

By checking your credit report it may help you decide when is a good time to actually apply for credit because if you have any issues on your credit report you can actually make some changes to help improve these issues and therefore improve your credit score when you do apply for credit.

So some things to look for when checking your credit report are to make sure your personal and credit account information is actually correct and complete.

It is possible that your lenders and creditors don’t report your payment history accurately or they may report partial information which may be viewed negatively.

You will also want to make sure that any old information on your report that can be viewed as negative such as late payments are removed if they have been there for more than 7 years.

Even hard inquires can affect your credit score so make sure that if there are any on your report that have been there for more than 2 years are removed.

If there are any inaccuracies you can actually contact the company that is reporting the information or file a dispute with them.

Just fixing these problems can give you a greater chance of approval for a mortgage and better terms and a lower interest rate.

Another thing to look out for is any fraudulent activity, this could be unauthorized credit checks on your account that you didn’t approve, and once again you would want to contact the company that is reporting it and let them know.

So you are entitled to a free copy of your credit report every 12 months from each of the 3 major credit bureaus which are Experian, Equifax, and TransUnion.

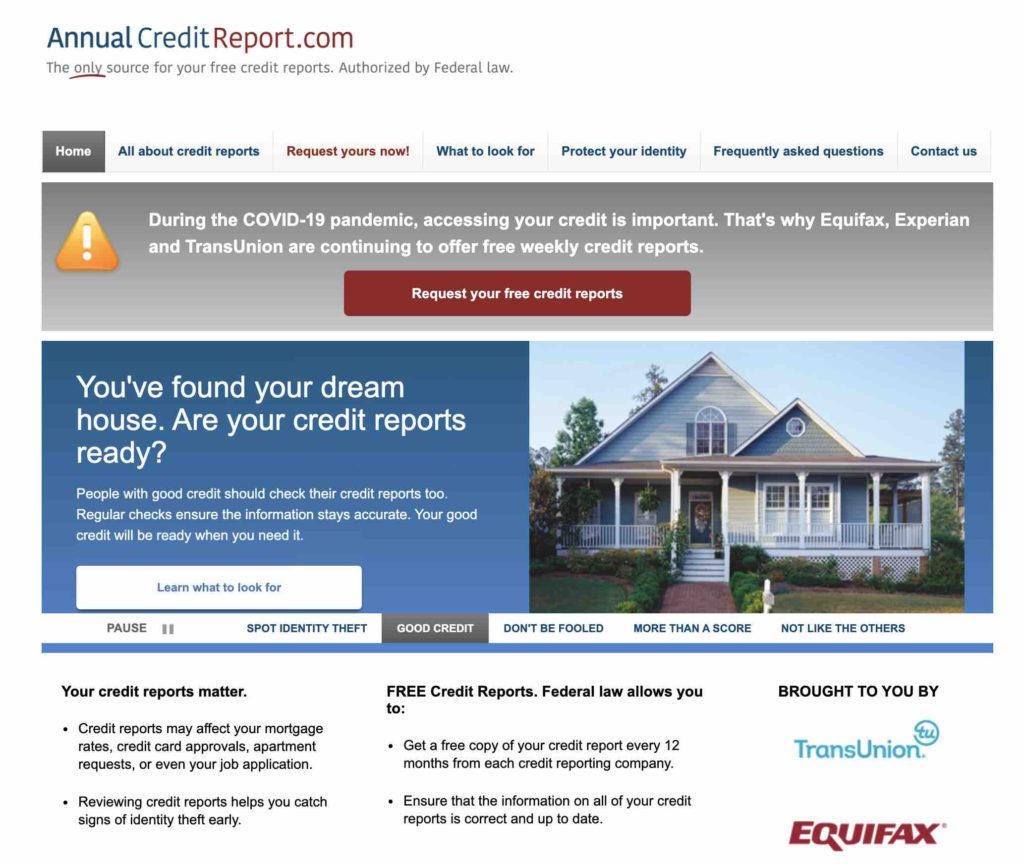

The easiest and quickest way to do this is by going to the government-mandated website www.annualcreditreport.com.

And because of the pandemic, annualcreditreport.com is actually allowing you to get free weekly credit reports until April 20th, 2022.

Just note that an annual credit report shows you a detailed rundown of your past use of credit but it does not include your credit score.

So let’s take a look at how to actually use www.annualcreditreport.com

Now you want to make sure you are actually on the correct site as there are a lot of sites that have a similar name and look the same.

So this is what it looks like:

And to check your credit report is pretty straightforward, Just click where it says ‘Request your free credit reports’

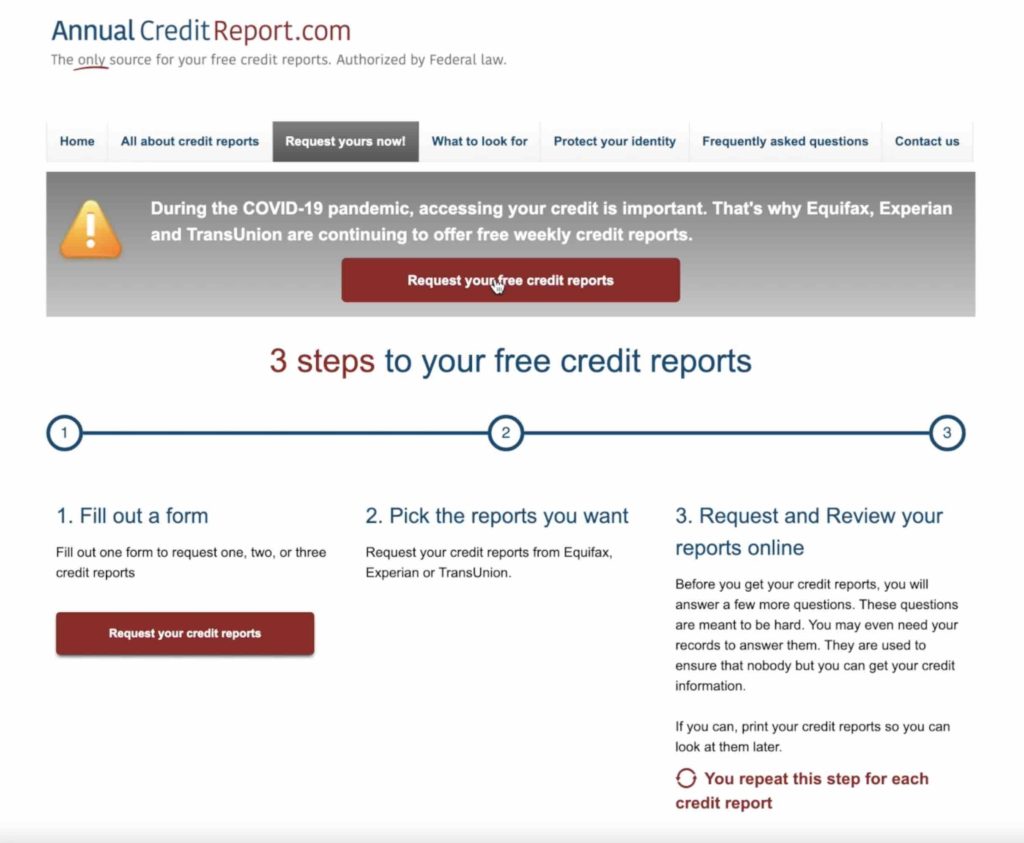

And on this next page, you will see that there are 3 steps:

So you will want to start on the first step where it says ‘Fill out a form’ -and click on ‘Request your credit reports’

And on the next page, you will need to fill out all of the relevant information. And then click next.

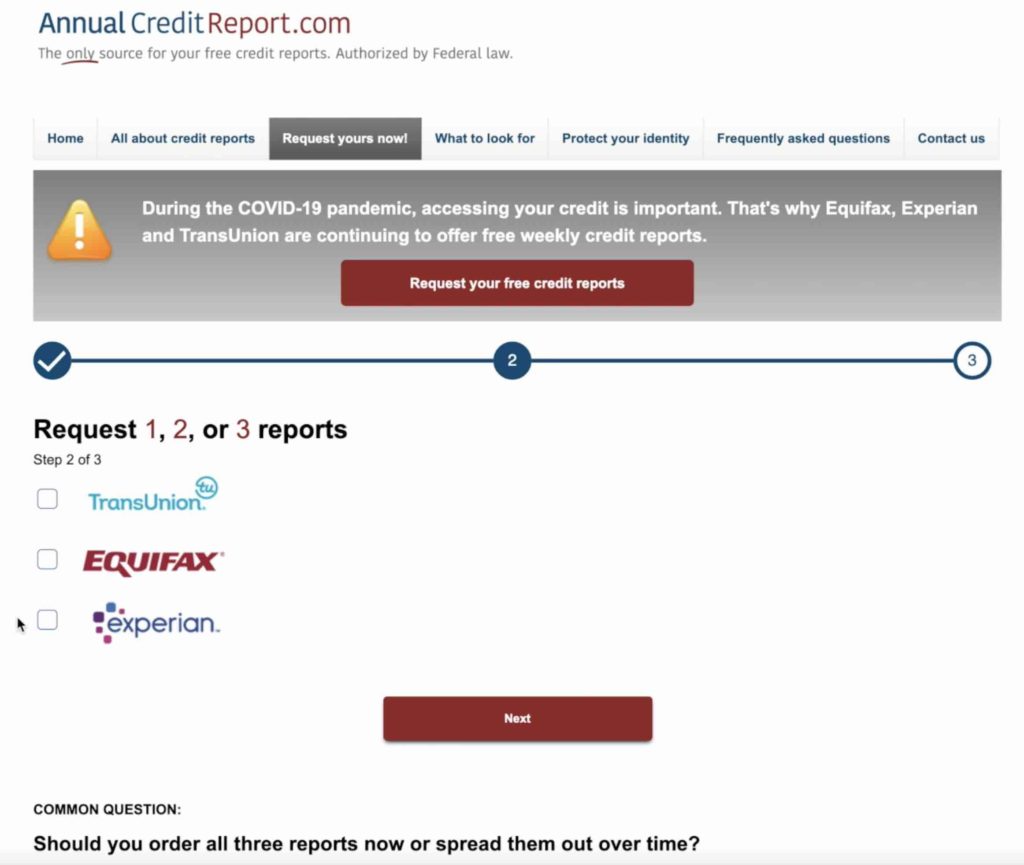

And for the second step of the process, you will see here that you can request 1, 2, or 3 reports from either Transunion, Equifax, or Experian.

Now depending on what you might be purchasing in the near future will help you make the decision on whether you get just one report or all three.

Basically, if you are making a relatively large purchase like a new car or a new home you might want to get all three reports so you fix any potential mistakes on them as soon as possible.

If you are not making any large purchases and just want to have a look at your credit report for personal reasons then maybe just select one report.

Also, make sure you keep a note of each time you request a credit report so you don’t lose track of how many you get each year.

So choose which one you want or choose them all and then click Next.

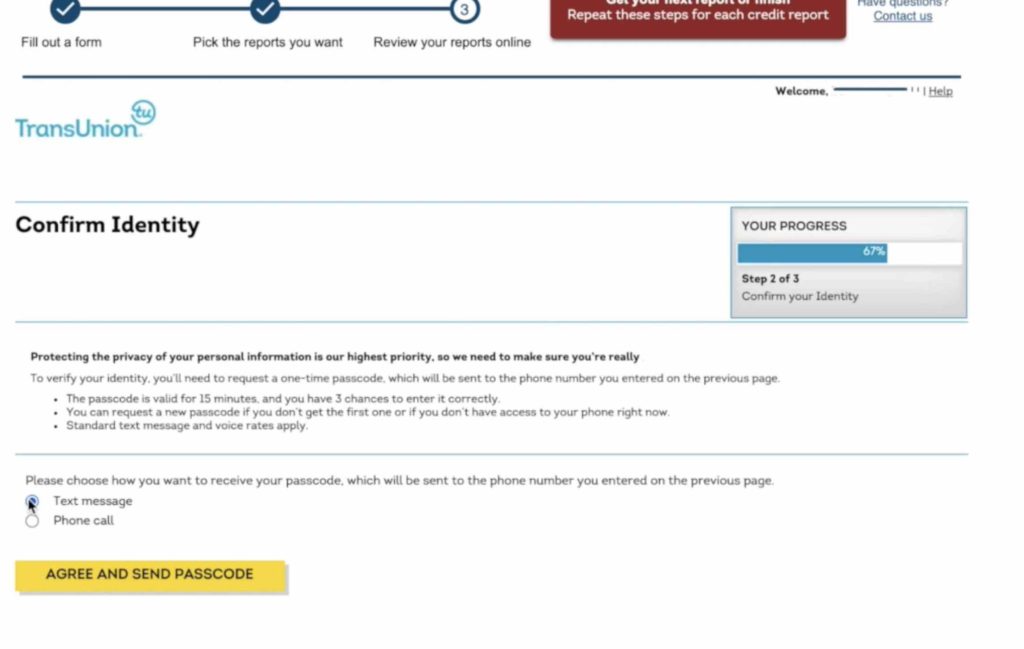

Ok, the next page it may ask for additional information which you can fill out.

Then it will ask to send you a text or phone call to confirm your identity, so choose which one you want and then click next

Once you have confirmed your identity click ‘continue’.

And on the final page, it will have your credit report, and you can see it if you scroll down the page.

Now I recommend that you save this information and even print it so you have it on record.

And if you see any incorrect information here you can file a dispute are where it says ‘Initiate a Dispute’.

Ok so that’s pretty much it, and as you can see it is relatively easy, it does not take long to complete and is totally free.

DESTINATIONS

New York City

London

Miami

Monaco

Los Angeles

Cannes

Geneva

Rome, Italy

RECENTLY REVIEWED

10 Best Luggage Sets

Best Carry-on Luggage Reviewed

10 Best Backpacks To Buy Now

Top Travel Accessories Reviewed

Best Men’s & Women’s Wallets

10 Most Comfortable Travel Pillows

Top-Rated Travel Adapters

10 Of The Best Toiletry Bags

Best External Hard Drive For Travel

10 Best Cruise Lines

Best VPN for Travel

Best Herschel Backpack For School