by Daniel | Last Updated August 25th, 2022

We may earn a commission for purchases using our links, at no cost to you.

There is a wide variety of different credit cards available that offer loyalty programs.

Some cards offer cash back incentives whilst other cards offer the ability to earn miles or points that can be redeemed in multiple different ways.

And depending on how you redeem these points can greatly affect the value of each point.

Now when you use specific American Express cards each time you make a purchase you will earn Membership Rewards Points.

In this article, I’m going to go over some of the best and worst ways you can use American Express Membership Reward points.

And the reason I wanted to make this video is to show you just how much value you can actually get from these points.

When I first got my Amex Gold card about 6 years ago I had no idea of the potential value these points had, and annoyingly for the first few months I had the card, I redeemed the points on very low-value rewards.

So hopefully this video helps you out and gives you some good ideas of what you can use membership reward points for and how much they can potentially be worth.

Now when you use an American Express card each time you make a purchase you will earn Membership Rewards Points.

And there is a large range of cards that Amex offers that actually earn Membership rewards points, from the inexpensive Amex EveryDay Credit Card which has no annual fee all the way up to the Centurion card which has an annual fee of $5,000!

Now generally speaking, the more you pay for your Amex card on an annual basis, the more points earning potential you get.

And this is pretty much the case all the way up to the Platinum card, which has the ability to earn up to 5x points for certain purchases.

Although that is not the case for the Centurion card which is limited to a maximum of 1.5x points earnings for purchases that are $5,000 or more.

Now besides the ability to earn points just from using the card for everyday purchases, it is possible to earn a large sign-up bonus from some of the cards they offer if you sign-up at the right time.

And this is something worth thinking about for a couple of reasons.

First of all, by receiving the largest possible sign-up bonus with a given card, there is an immediate increase in the amount of value that you will receive with the card, which in some cases can be worth up to $500 more than what the original sign-up bonus was.

The second reason is that once you have received a sign-up bonus from Amex for a specific card it is not possible to receive it again for that card due to their ‘Once in a lifetime welcome bonus policy’

So it makes sense to try and receive the largest possible sign-up you can.

Now on a side note, if you happen to get a personal credit card from Amex, it is possible to receive the sign-up offer on the same related business card.

For example, if you get the Amex Platinum personal card and receive the sign-up bonus, it is still possible to receive the sign-up bonus for the Amex Business Platinum card.

But just know that after this, it is highly unlikely you will receive a sign-up bonus for either of these cards in the future.

American Express increased sign-up bonus options

So now let’s take a closer look at a few different ways that you can potentially receive a larger sign-up bonus.

And for this example, let’s use the Amex Platinum card.

Amex Pre-qualify Tool

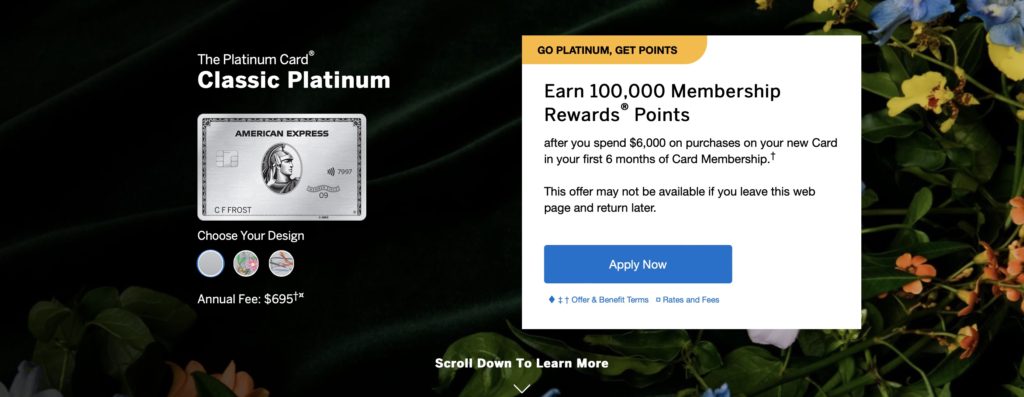

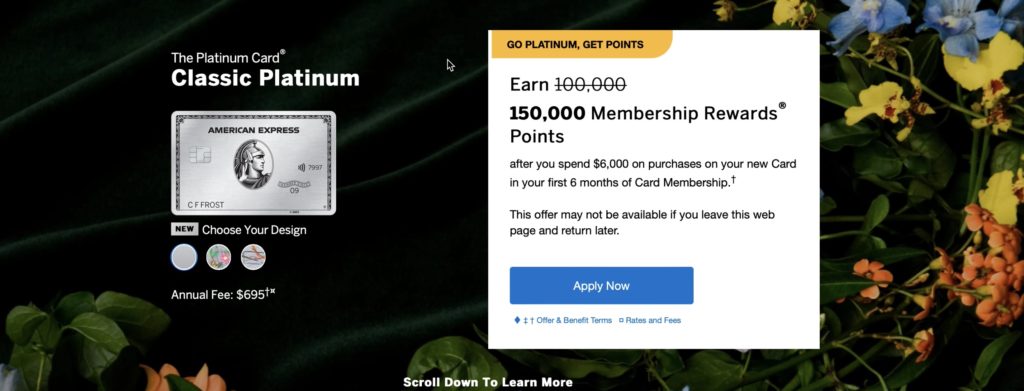

So as you can see in the picture below, it is currently possible to receive 100,000 Membership Reward Points if you spend $6,000 on purchases within the first 6 months of opening the account.

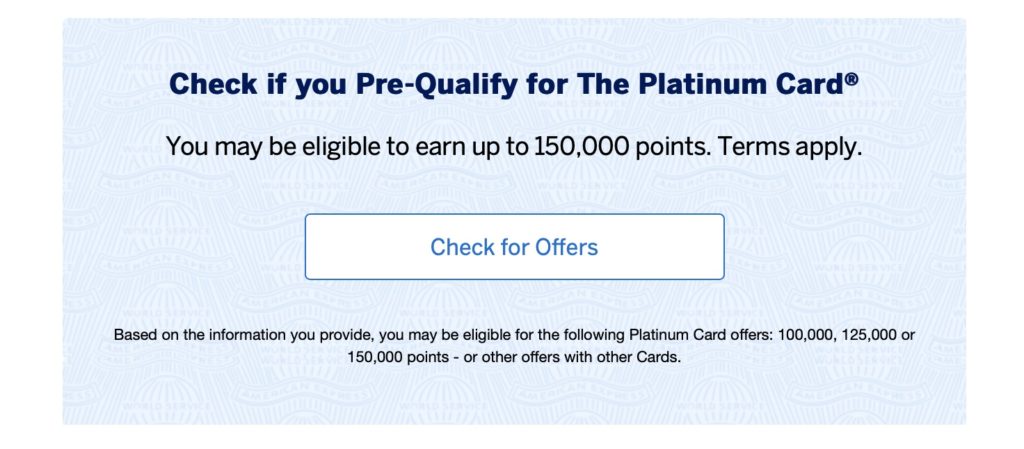

Now if you just scroll down the page a little further you will see a box that says ‘Check if you Pre-Qualify for The Platinum Card‘ and then it says you may be eligible to earn up to 150,000 points.

So just click where it says ‘Check for Offers’ and fill out the information that is required.

Then you should receive an answer relatively quickly.

And just note that Amex specifies that ‘There is no impact to your credit score to check for Pre-Qualified offers.’

CardMatch Tool

Now if the Amex pre-qualify tool doesn’t offer you a better signup bonus, it is possible to try the ‘CardMatch’ tool that is offered on the website creditcards.com

And this is another simple way of seeing it is possible to receive an enhanced sign-up bonus for a variety of different credit cards.

And similar to the Amex pre-qualify tool, it only performs a soft credit check which means that it won’t affect your credit score.

Basically, there will only be a hard credit check when you actually apply for a given credit card.

Other Options

Now finally, if neither of these options provides an increased signup bonus offer, I would recommend trying to use an Incognito web browser and then looking up the desired credit card to see if it makes a difference.

Also sometimes trying to search for the same card a few hours later or the next day can also work.

As you can see in the screenshot below, I’ve managed multiple times to find a 150,000-point sign-up offer for the Platinum card.

And these 50,000 extra points can be worth upwards of $500 or more depending on how you redeem them.

How To Earn Amex Points

Now besides earning membership rewards points from the sign-up bonus, there is a whole variety of different ways where it is possible to earn points, and the number of points you earn will depend on which card you end up choosing and then where you make the most of your purchases.

So as an example, let’s take a look at 3 popular American Express cards and see how they differ in terms of their sign-up bonus and points earning ability.

Starting first with the American Express Green Card it is currently offering the ability to earn 45,000 Membership Rewards Points after spending just $2,000 within the first 6 months of card ownership.

Then, the American Express Gold Card is offering 90,000 Membership Reward Points after spending $4,000 within the first 6 months of card ownership.

And finally, the American Express Platinum card is offering 125,000 membership reward points if you can manage to spend $6,000 on purchases within the first 6 months of opening the account.

So based on Membership Reward Points being valued at up to 1 cent per point, there is the ability to earn a decent amount of value from each card just from the initial sign-up bonus.

With the Amex Green card sign-up being worth $450, the Amex Gold card is worth $900, and the Amex Platinum being worth $1,250.

And as I mentioned at the start of this video, it is possible to receive a larger sign-up bonus if you try some of the methods that I mentioned.

Also, this valuation is based on points being worth 1 cent per point, which is pretty good, but as you will see later in the video it is possible to receive a much higher value per point if you redeem them in the right way.

Now along with the sign-up bonus, each card comes with different points earning options that can make quite a big difference to how many points you earn assuming you spend through the highest points earning options.

For example, the Amex Green card has a nice range of options for earning 3x points which include:

- Purchases made at restaurants worldwide, and then takeout and delivery services within the US.

- Purchases made on a wide variety of transit, such as trains, ferries, busses, and more.

- Travel expenses that include airfares, hotels, car rentals, and more

And then everything else will earn 1 point for each dollar spent.

Now as the Amex Gold card is a more expensive and exclusive card than the Green card, it has the potential to earn slightly more points on particular purchases which are:

- 4x points at restaurants worldwide, and then US takeaway and delivery.

- 4x points on grocery purchases at US supermarkets up to $25,000 each year.

- 3x points on flights that are booked directly through Amextravel.com

And then everything else will earn 1 point per dollar spent.

And then with the most exclusive card of the three, the Amex Platinum card has the following options for earning points:

- 5x points on flights that are booked either directly with the Airline or through American Express Travel, although this is limited to a total spend of $500,000 each year.

- Then 5x points at hotels that are booked through AmexTravel.com

Then all other purchases will earn 1 point per dollar spent.

So with the Amex Platinum card you actually miss out on the ability to earn increased points on restaurants or grocery purchases, but on the positive side, you get the highest points earning potential on most travel-related purchases.

Other ways to earn Membership Reward Points

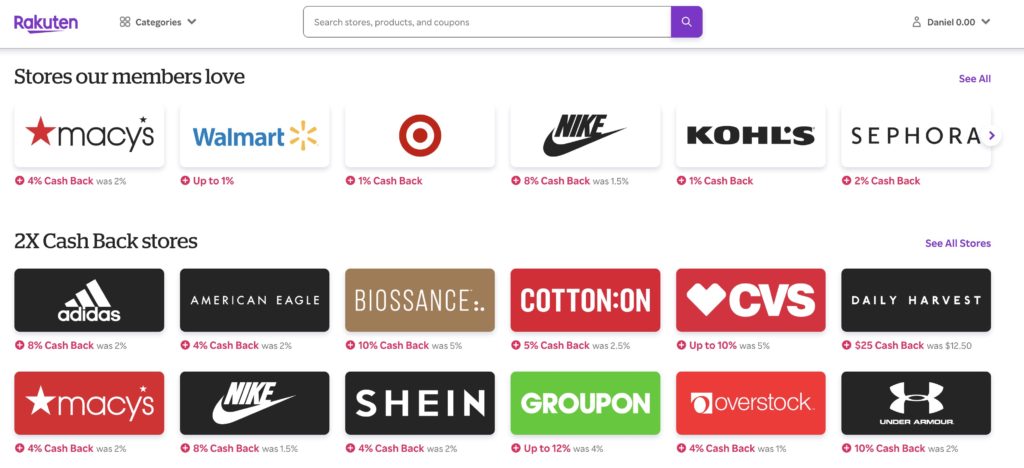

Now another easy way to earn some Membership reward points is to sign up to Rakuten here and create an account.

And if you can manage to spend just $30 within the first 90 days of becoming a member it is possible to earn a bonus of $30 or 3,000 Amex points, which is pretty good in my opinion.

Basically, Rakuten is an online shopping portal that has more than 12 million US members and over 3,500 different stores to shop from.

And it is not uncommon to find special deals that offer cash back on purchases of up to 10%.

Now there are a couple of other ways to earn Membership Reward points.

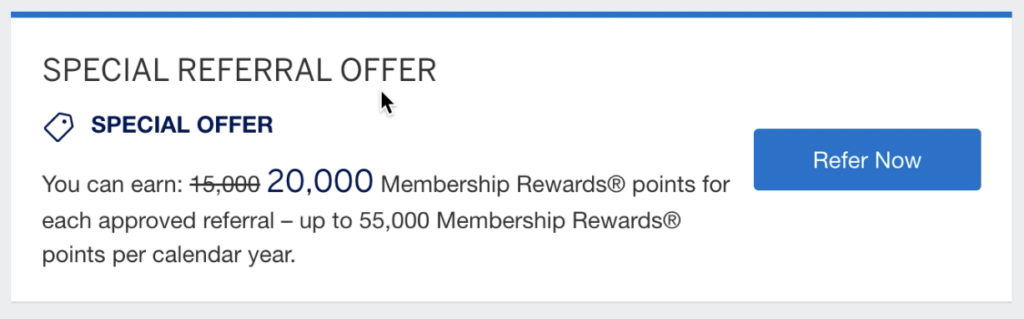

The first would be to refer someone via a link that you can find once you sign into your Amex account.

As you can see in the picture below there is a section that says ‘Special Referral Offer’ and currently, it is possible to earn 20,000 Membership reward points for each approved referral up to a total of 55,000 points per calendar year.

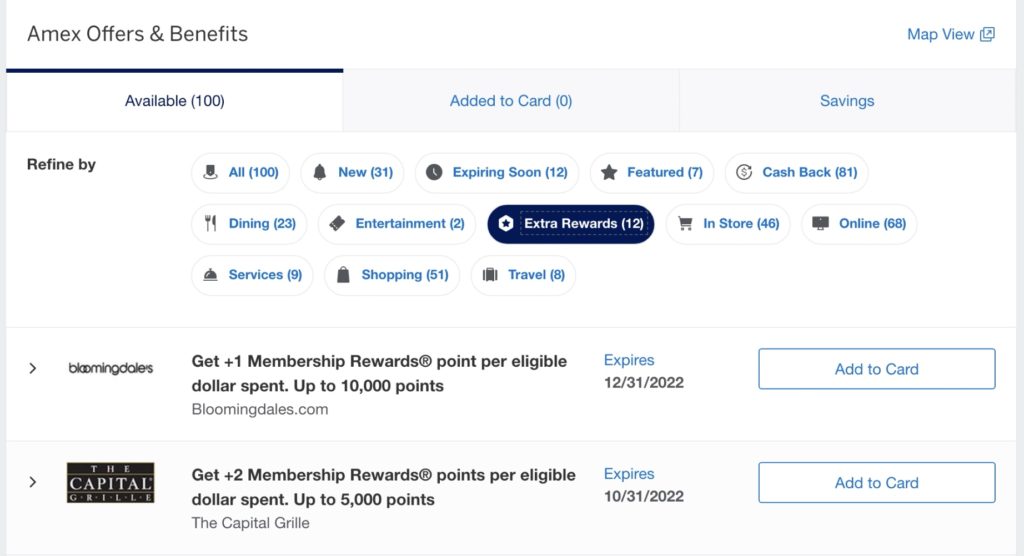

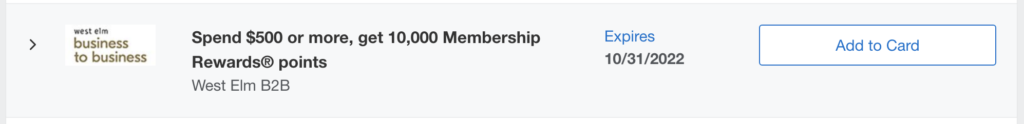

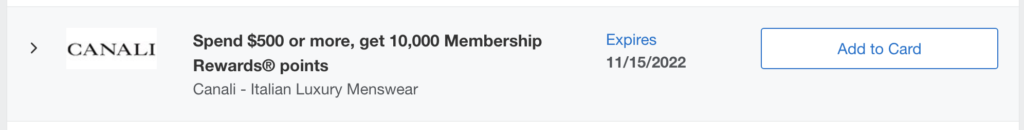

Now another way to receive increased Membership Reward points is to look through the Amex Offers & Benefits.

And this list changes quite often with some really good options to earn some pretty decent points.

Now not all of the offers are going to suit everyone but an example of a pretty good offer that is currently on the site is the ability to earn 10,000 membership rewards points after spending $500 or more at West Elm Business to Business, or the same 10,000 points for spending $500 at Canali.

And this means that a combined $1,000 purchase would net you 20,000 Membership Reward Points, which is pretty good.

Using Amex Membership Reward Points (the wrong way)

Now once you have accumulated a certain amount of Membership Rewards Points from Amex it is possible to use these points in quite a few different ways.

And as you will see in the following section, there are a couple of examples that don’t really provide much value and aren’t really a very good way to utilize your points.

For example, it is possible to make general purchases at a variety of different locations by using the ‘Pay with Points’ option, which can be used for partial or full payments for certain products at participating businesses.

And by using this option, the points will have a value of between 0.5 cents when used at Ticketmaster, all the way up to 1 cent per point for use on NYC Taxies.

But if you don’t live in NYC, the average return you will receive for using these options is 0.7 cents per point, which is ok, but not the best use for Amex points.

Now when using the points through American Express Travel for flights or flight upgrades, it will net you a 1 cent per point valuation, which is defiantly better than 0.7 cents per point when using the Pay with points option.

Along with this, bookings made at the Fine Hotels & Resorts through American Express Travel will also net 1 cent per point.

Now it’s worth noting that if you get the Amex Business Platinum card it is actually possible to receive even more value than the personal Platinum card.

Basically, if you book any First or Business class ticket through American Express Travel with your points it is possible to receive 35% membership Reward Points back, and if you prefer to book an economy ticket you can use your selected airline partner which can only be changed once per calendar year.

And this offer is limited to a maximum of 1 million points back each calendar year.

So receiving 1 cent per point is pretty good, and then getting 35% of your points back is even better, but in the next section of this article, I will show you how you can earn substantially more value with your points.

The Most Effective Way To Use Amex Membership Rewards Points

Now a far more valuable way to get more value from your Membership Rewards Points is to transfer your points to one of 17 different airline partners or 3 hotel partners.

And as I will show you now there is the potential to receive massive value if done correctly.

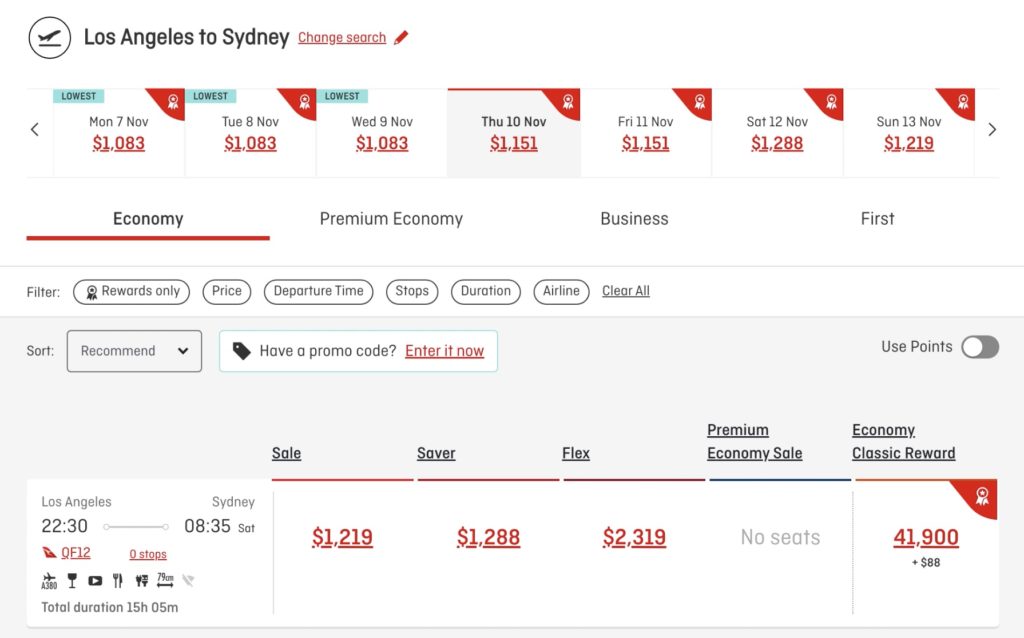

So as an example, with Qantas, it is possible to transfer points at a 1:1 value.

Now looking on the Qantas website at an Economy flight you can see here that the cheapest option is $1,219, but if you transfer your Amex membership rewards points to Qantas frequent flyer points, it only requires 41,900 points plus $88 in fees, which is quite a bit cheaper!

So if you were to value the points at 1 cent per point, the flight would cost the equivalent of $507, which is more than half the cost of paying for the flight.

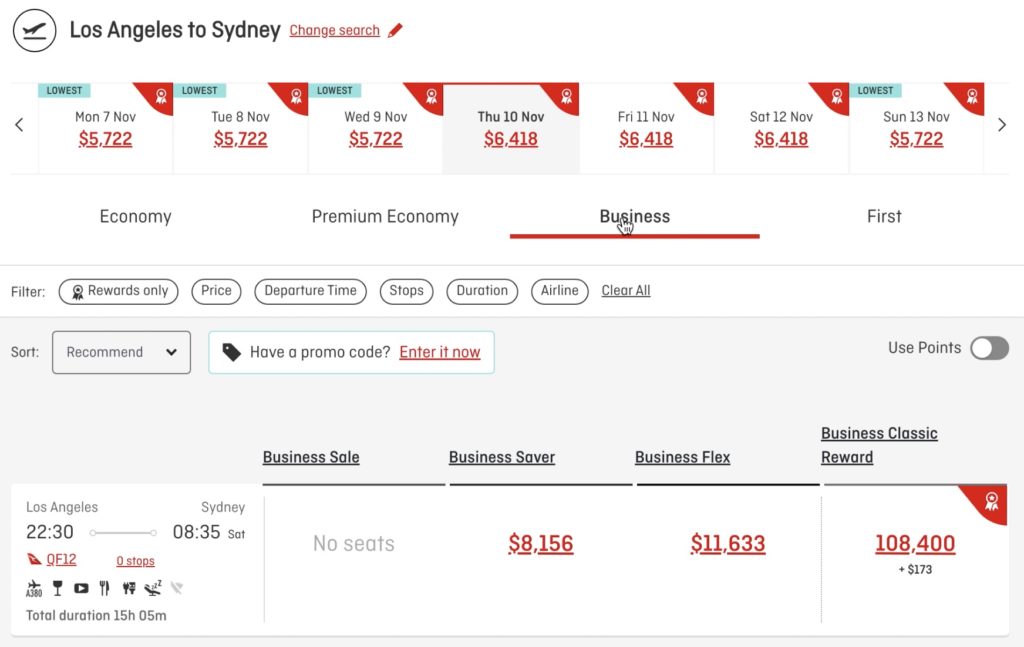

Now looking at a Business class one-way fare on the same flight, it will cost $8,156 for a Business saver ticket, which is pretty expensive.

But if you use Qantas Frequent flyer points it will require just 108,400 points and an additional $173.

So if you value points at just 1 cent per point, this fare would cost the equivalent of $1,257, which is more than a sixth of the cost of paying for the flight.

Or if you want to look at it another way, if you take the $173 off the ticket fare of $8,156, you are left with $7,983.

And this would value the 108,400 points required for the flight at 13.57 cents per point?!

Which is amazing value.

So if you are lucky enough to receive the 150,000 Membership Reward point sign-up bonus it can be worth in excess of $8,000.

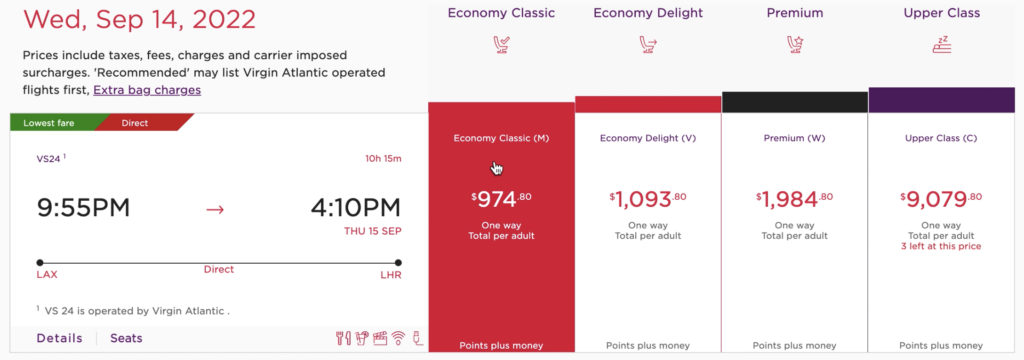

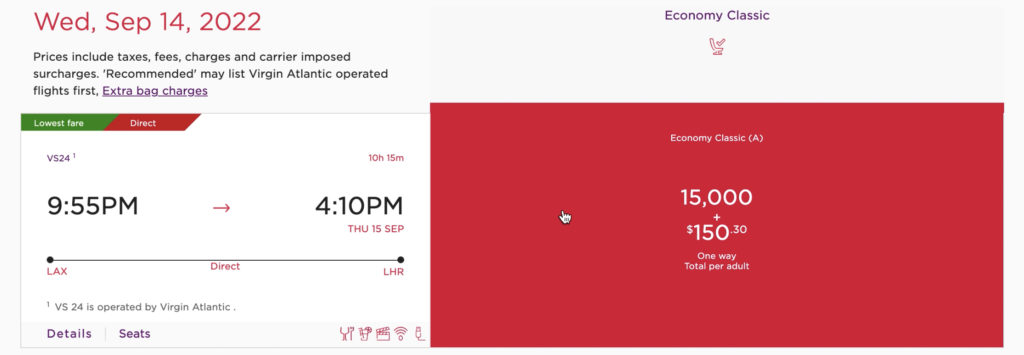

Now let’s look at Virgin Atlantic, which also offers the ability to transfer points at a 1:1 value.

And looking at the Virgin Atlantic website at an economy flight from LA to London 3 weeks in advance, the price is $974.80.

But if you decide to use points it will only require 15,000 points and an additional $150.30 for the same flight, which is substantially cheaper!

So if you did only value the points at 1 cent per paint, this works out to be $300 for the same flight, which is a saving of $674.80!

Now it’s worth noting that the cost of flights and points required for certain sectors will change quite often, so it’s always worth checking some of the different airline partners that are associated with Amex and different dates to get the best possible value.

Final thoughts

So there you have it, that pretty much covers everything there is to know about American Express membership So there you have it, that pretty much covers everything there is to know about American Express membership reward points, specifically where you can find the most value from.

Now if you found this article interesting, I recommend checking out this article here where I review and compare the Capital One Venture X, the Chase Sapphire Reserve, and the Amex Platinum Card.