by Daniel | Last Updated April 6th, 2023

We may earn a commission for purchases using our links, at no cost to you.

Is the Amex Centurion card really worth 20x the cost of the Amex Platinum card?

That’s how much more you will need to pay initially to get the Centurion card thanks to its $10,000 initiation fee and then $5,000 annual fee.

It really makes the Amex Platinum Card look cheap in comparison and fantastic value!

So in this article, I’m going to be talking about two of the most exclusive cards out there: the American Express Platinum Card and the American Express Centurion Card.

And I’m going to try and understand why on earth would anyone pay a whopping $15,000 just to have a credit card.

I’ll also dive deep into the benefits and perks of both cards, which should better explain why some people are willing to pay a premium price for the Centurion Card.

So, sit back and relax and get ready to learn everything you need to know about these two exclusive credit cards.

And trust me, by the end of this article, you’ll have a better understanding of what sets these cards apart and which one might be right for you

Benefits and User Perks

So let’s start with probably the most important information about both of these cards which is what benefits and user perks are currently on offer with each card.

This should give you a much better understanding of how much value you can squeeze out of each card.

Starting first with the Amex Centurion Card there are some pretty valuable benefits to be had.

Centurion New York

Just completed this year is the stunning Centurion Club in Manhattan, which is called ‘Centurion New York’.

This is an exclusive 11,500-square-foot club that is located on the 55th floor of the One Vanderbilt building which is right next to the Grand Central station, and apparently, the club has absolutely stunning views of Manhattan from its floor-to-ceiling windows.

Now there are three separate spaces in this club, the first room is known as ‘The Salon’ and this is designed as a meeting area and is the most informal room in the club, here you can just meet up with friends or just hang out.

The new room which is a little more formal is called ‘The Studio’ and this is where you will find a bar and restaurant that has an a la carte menu.

The final room, which is the main dining room is referred to as ‘The Gallery‘, and here you will experience stunning views, amazing artwork, and a menu designed by the Michelin-starred chef Daniel Boulud.

Now the check-in is located at the Madison Avenue lobby of One Vanderbilt Avenue, which is between 42nd and 43rd street, and to access the club you will need to bring your driver’s license or passport and then have the lobby attendant validate your reservation.

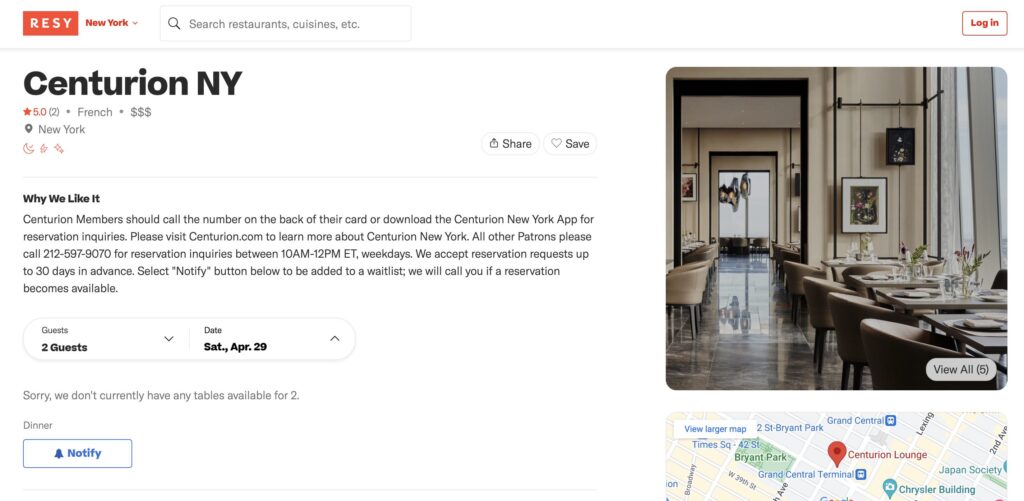

Now if you have a Centurion card it is possible to make a booking by either calling the number on the back of your card or you can just download the Centurion New York App where you can search for a reservation.

If you don’t have a Centurion card you will need to call 212-597-9070 between 10 am -12 pm EST Monday to Friday.

It is also possible to make a reservation through RESY, but given that it has just opened in March this year and is very popular, it is going to be pretty difficult to find a reservation.

When looking on RESY, it is only possible to book up to 30 days in advance, and at the time of writing this article, there are no tables available.

Alternatively, if you just click the Notify button on the RESY website, you can just leave your mobile phone number to be notified if a reservation happens to come up.

Just note that if you do make a booking and have to cancel less than 24 hours prior to your reservation, there will be a cancellation fee of $100 per person.

Equinox Destination Access Membership

The most valuable benefit on offer is an Equinox Destination Access Membership. This basically provides you with access to all clubs worldwide.

So if you happen to be in the UK for business or visiting friends in Canada you will be able to access one of their gyms in either one of those countries.

Now a destination access membership with Equinox is not exactly cheap, on their website it shows that it can cost up to $382 per month, which works out to be $4,585 a year.

So just this one benefit, if you happen to make use of it almost covers the total cost of the annual fee each year.

Now with the Amex Platinum Card, you will receive a $300 statement credit at Equinox gyms which is pretty good and enough to cover about 1 month of membership.

$1,000 Credit at Saks Fifth Ave

Now another reasonably valuable benefit that comes with this card is a $1,000 credit that can be used at Saks Fifth Avenue and this is available in $250 credits each quarter.

So if you make full use of this benefit and the Equinox benefits the annual fee is totally covered and you will be left with $585 in additional value.

Then with the Amex Platinum Card, there is a $100 credit for use at Saks Fifth Ave, and this is split in to 2 separate credits of $50, the first can be used between January and June, then the second credit can be used between July and December.

P/S Annual Membership

Now if you happen to be traveling out of LAX you will be able to visit the exclusive private terminal called P/S (formally known as The Private Suite at LAX)

With the Amex Centurion Card is it actually possible to receive an annual membership to PS which will allow you to receive discounted rates each time you visit.

Now memberships start at $1,250 for The Saloon Membership and go up to $4,850 for an All Access membership, and I’m not 100% sure which membership you will receive but it’s worth at least $1,250.

Now as nice as this sounds, there is still a large amount to pay if you do happen to visit the Private Suite.

Even if you have the All Access Membership, it will still cost $695 per person to access the Salon, this is $300 cheaper than what you would pay if you don’t have a membership.

And then if you want to access a Private Suite it will set you back $3,450 for up to 4 travelers.

Without a membership this price rises to $4,650, so basically you can save $1,200.

CLEAR Credit of $329

Now if you happen to be flying through a normal airport terminal like everybody else you will receive a CLEAR statement credit of $329 each year and this can be used for the cardholder and up to 3 family members.

And this can in some cases save you a bit of time when going through airport security assuming they have CLEAR access.

Although I must say that the last 2 times I used CLEAR it didn’t make any difference to have fast I got through security.

Now with the Amex Platinum Card, there is also a CLEAR credit but it is limited to $189, which just happens to be exactly how much an annual membership costs.

Delta SkyMiles Platinum Medallion status

Another valuable benefit that only comes with the Amex Centurion card is Delta SkyMiles Platinum Medallion status,

and this comes with a whole range of nice benefits if and when you decide to fly with Delta.

Some of these benefits include:

- 4 Regional Upgrade Certificates worth around $350

- 4,000 Starbucks Rewards Stars worth around $100

- $500 Medallion Qualification Dollars (MQD) that can be used towards the next Medallion Qualification Year

- There is then the ability to gift Silver Medallion Status to 2 Members, and this is worth at least $500 in value.

- You will then receive 20,000 Delta bonus miles that are worth around $240.

- There is a $400 Delta Vacation Experience

- A $250 Delta travel voucher

- A $250 Sustainable Aviation Fuel Contribution

- When flying on a Delta-marked flight you can earn 9 miles per dollar spent (Delta miles)

- And then best of all, Unlimited Complimentary Upgrades for you and one companion.

So the Delta SkyMiles Platinum Medallion status is worth at least $2,000.

Hotel Status

Now in terms of Hotel status, the Amex Centurion Card offers some really amazing value.

- Marriot Bonvoy Gold Elite Status, this includes benefits such as room upgrades, 25% bonus points on stays, and 2 pm late checkout.

- Hilton Honors Diamond Status, this provides Executive lounge access, room upgrades, and the ability to earn up to 30 points per dollar spent.

- IHG One Rewards Platinum Status, this also comes with complimentary upgrades, early check-in, and late checkout.

And along with this, there is the Centurion Hotel Program, which provides a credit of up to $200 for bookings of 2 nights or more made through either the Fine Hotels and Resorts program or the Hotel Collection.

Now the Amex Platinum Card also comes with very similar Hotel status options.

Basically, you will receive the following:

- Marriott Bonvoy Gold Elite Status

- Hilton Honors Gold Status

- The same access to the Fine Hotels and Resorts program and the Hotel Collection, the only difference is that the credit is limited to just $100 with the Platinum card versus $200 with the Centurion card.

Car Rental Benefits

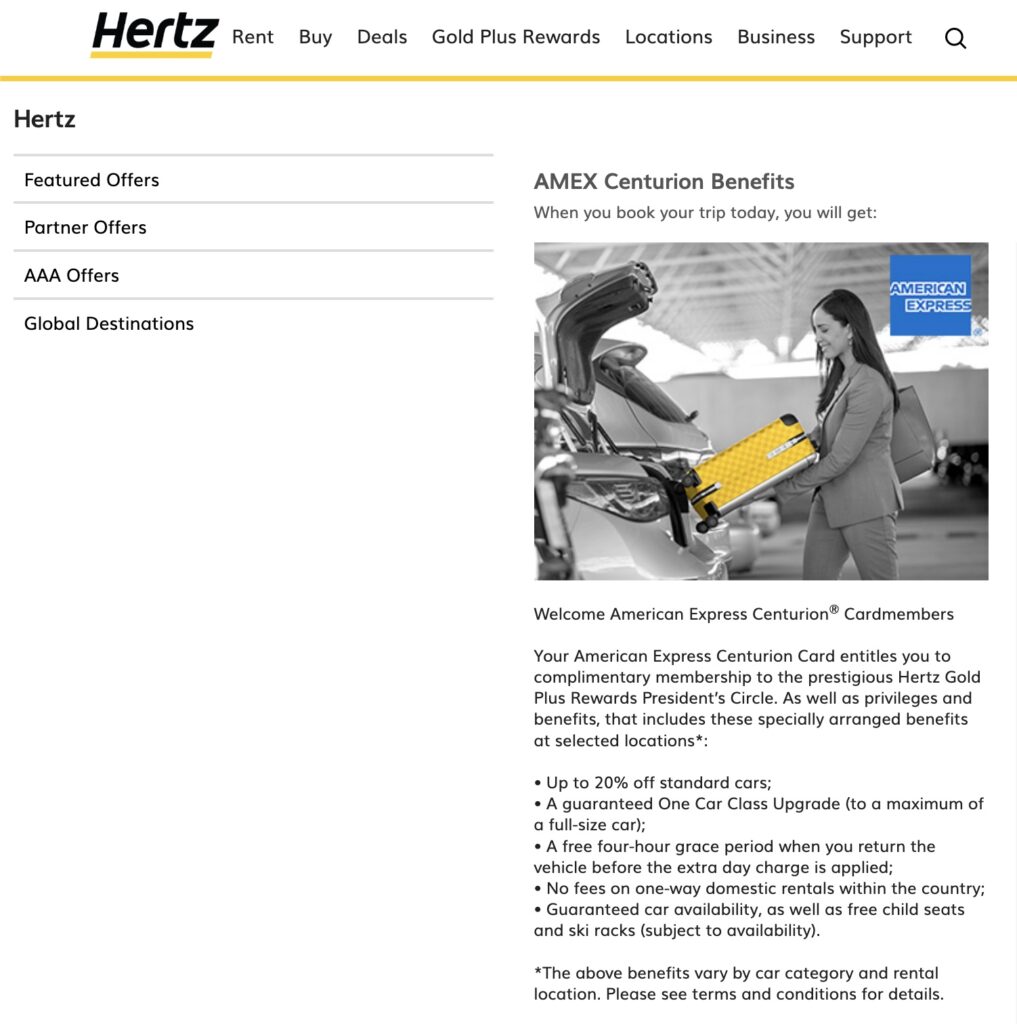

So again similar to the hotel status available with each card, there is car rental status provided with each card with the Centurion card you will receive a higher status than the Amex Platinum Card.

- Avis President’s Club, this includes the ability to receive a free two-car class upgrade and a dedicated support phone number.

- Hertz Gold Plus Rewards President’s Circle, this provides guaranteed upgrades and a free additional driver.

- Sixt Diamond Card (which is invitation only), this provides you with access to the Diamond lounge and VIP service, a guaranteed upgrade for free, and up to 20% off SIXT bookings

Now with the Amex Platinum Card, you will receive the following car rental status:

- Avis Preferred

- Hertz Gold Plus Rewards – Presidents Circle

- National Car Rental Emerald Club Executive

- So still a very good status offering, just not quite as elite as what the Amex Centurion Card is offering.

Cruise Privileges Program

Now both the Centurion card and the Platinum card are part of the cruise privileges program, and with this, it is possible to receive a shipboard credit of up to $300 for bookings that are made through American Express Travel and that are at least 5 nights or more.

The Global Lounge Collection

Both cards also offer access to the global lounge collection which is a fantastic benefitting my opinion.

This will provide you with access to the following lounges:

- Centurion Lounge

- Delta Sky Club

- Lufthansa Lounge Access

- Escape Lounges

- Plaza Premium

- Air Space

One difference between the two cards is that the Centurion card allows you to bring in 2 guests to the Centurion lounge free of charge whereas the Platinum card now requires you to pay $50 per guest.

The only way past paying the $50 fee per guest is to spend at least $75k on the card within a calendar year, if you meet this requirement you will be able to bring in your 2 guests for free.

And then finally you will receive a complimentary Priority Pass Select membership that is worth $469, this provides you with access to well over 1,200 airport lounges from all over the world.

Having access to all of these lounges really does make flying a whole lot more enjoyable, I use this specific benefit with my Amex Platinum card multiple times a year and really like it.

Annual Fee and Initiation Fee

Now it’s relatively well known that the Amex Platinum Card has a pretty hefty annual fee of $695, which is not exactly cheap, but if you take full advantage of the cards benefits and user perks it is relatively easy to make up of the cost of the annual fee and still be left with a ton of value.

But when you compare this to the Centurion card’s annual fee of $5,000 and initiation fee of $10,000, the platinum card sounds cheap!

At least for the first year of card ownership, the Platinum card is just under $58 a month, whereas the Centurion card is $1,250 a month (or just over 21 times more expensive).

Now after the first year of card ownership, the Centurion card’s monthly cost drops down to just over $416 which is lot better than $1,250, but still relatively pricy.

Sign-up bonus

Now interestingly enough the Amex Centurion Card doesn’t offer any sign-up bonus at all which is somewhat surprising given the cost of the card, but it is what it is.

On the other hand, the Amex Platinum Card is currently offering 80,000 membership Rewards points if you spend $6,000 on purchases within the first 6 months of card ownership.

And with Membership Rewards points been worth 1 cent per point, this sign-up bonus is worth $800.

Now it’s not uncommon for the sign-up bonus with the Platinum card to change quite often, I have previously seen up to 150,000 points on offer which is really quite valuable.

And if you’d like to learn how to get the best sign-up bonus possible with the Amex Platinum make sure to check out this article here.

Earning Membership Rewards Points

So with the Amex Centurion Card, they’re really isn’t much variety in the way of earning points.

The only options are the ability to earn 1 point per dollar spent on all purchases and then for any purchases that are $5,000 or more it is possible to earn 1.5x points, and this is limited to a total spend of $1 million each year.

Now with the Amex Platinum card, it is possible to earn more points for a slightly wider range of options.

First of all, it is possible to earn 5x points on flights that are booked directly with airlines or through American Express Travel, and this is limited to a total spend of up to $500,000 per year.

It is also possible to earn 5x points on pre-paid hotels that are booked through AmexTravel.com.

And then finally, all other purchases that are made on the car will receive 1x point per dollar spent.

Insurance Coverage

So finally there is a pretty extensive list of insurance-rated coverage that comes with both cards, this includes:

- Car Rental Loss and Damage Insurance covers up to $75k in case of an accident, and this is secondary insurance.

- Cell Phone Protection of up to $800, with the ability to make 2 claims per 12-month period.

Each claim will incur a $50 deductible fee. - Trip Delay Insurance provides up to $500 per covered trip with the ability to make 2 claims per 12-month period.

- Trip Cancellation and Interruption Insurance provides coverage of up to $10,000 per covered trip and a total of $20,000 per 12-month period.

- Purchase Protection which provides 90 days of coverage on new purchases against damage or theft, this covers up to $10,000 per occurrence and $50,000 per year.

- Return Protection provides 90 days of coverage for items that a merchant won’t take back.

This covers up to $300 per item and a total of $1,000 per year. - Baggage Insurance Plan which covers checked baggage for up to $2,000 and carry-on luggage for up to $3,000

Now the only main difference between the two cards is the Extended Warranty protection.

Basically, with the Platinum card you will receive 1 extra year of coverage on warranties that are 5 years or less, then with the Centurion card, you will actually receive 3 years of additional coverage.

Final Thoughts

So after going through all of this information I can actually see why the Amex Centurion card has such a high annual fee and an initiation fee as well.

Just the benefits alone that I mentioned in this video are worth around $10,000 each year, which more than covers the cost of the annual fee.

Along with this apparently, Centurion cardholders receive surprise gifts on occasions that can be worth hundreds of dollars, and then there is a Personal Centurion concierge assigned to your account which is said to be an amazing service to have access to.

And to be honest, most people who are in the market for this card won’t mind too much parting ways with $15,000 to initially get the card.

If they’re spending at least $250k or more each year on their card, this is just another expense that will be absorbed by their already high spending habits.

And I must say that if I were in the position to have a Centurion card I would find it pretty hard to say no!

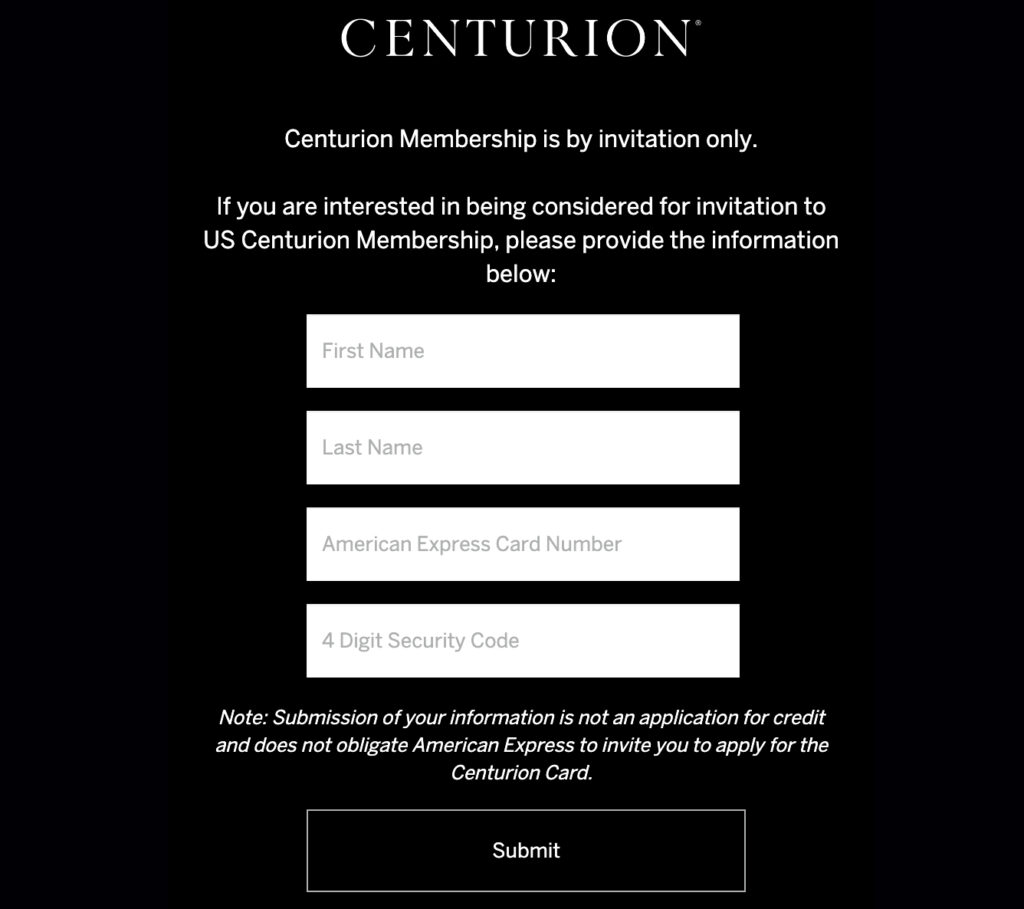

Now even thought to be Centurion card is widely considered to be an invite-only card it is actually possible to apply through American Express through this link.

But just note that if you are considering applying for the Centurion card its worth being aware that you will need to spend approximately $250,000 on your current Amex Card before they will even consider your application.

Now if you found this article interesting and you’d like to learn how to get the maximum value from your Amex Membership rewards points check out this article here.