by Daniel | Last Updated Feb 1st, 2023

We may earn a commission for purchases using our links, at no cost to you.

The IHG Rewards Premier credit card is offering a whopping 175,000 bonus points which just happens to be the largest signup bonus this card has ever offered.

Along with this, it is also possible to earn a ton of extra points when staying at IHG properties.

And this makes me wonder, is this the best value hotel rewards card under $100?

In this article, I’m going to take you through everything there is to know about the IHG Rewards Premier card and how you can stay at some seriously nice hotels technically for free just by using the points from the signup bonus.

Who is this card good for?

Needless to say, this card is most suitable for anyone that will be able to take advantage of all of the benefits that are on offer, Which just so happen to be all IHG related.

Even if you only plan on staying at an IHG-related hotel just a few times a year, it shouldn’t be too hard to earn quite a decent amount of value from this card.

Sign-up Bonus

So currently the IHG Rewards Premier credit card is offering its largest sign-up bonus ever, which is 175,000 bonus points after you spend at least $3,000 on the card within the first 3 months of opening the account.

Now there are a few ways to value this sign-up bonus, if you just go by what each point is worth, which is 0.5 cents per point, this sign-up bonus is worth $875, which is pretty good value for a credit card that only costs $99 per year.

Where can you stay with 175,000 points?

But let’s see how much value it is possible to receive by using the points to book a hotel room through the IHG portal.

So one example would be booking two nights at The Ranch at Laguna Beach which is a boutique hotel.

And if you are paying cash the room per night will cost $548, so two nights come to $1,096.

Now if you use points to stay here it will cost 82,500 points, so two nights will end up requiring 165,000 points.

So just this example provides you with $1,096 in value and still leaves you with 10,000 spare points.

Now it is actually possible to receive even more value than this, seeing that this card provides you with IHG Rewards Platinum Elite status it is possible to receive your 4th night free when using your points to book 4 consecutive nights at an IHG property.

So for this example, if you were to book 4 nights at the Hotel Indigo Miami Brickell, the cost for the dates I chose is $239.40 per night, which works out to be a total of $957.60 for a four-night stay.

Now if you choose to use points for this stay, it will require 44,750 points per night, which over 4 days would require 179,000 points, but because you receive the 4th night free it will only require a total of 134,250 points.

This leaves you with 40,750 points, which are worth at least $200, so technically this would value the sign-up bonus at around $1,157.60 if we use this specific example.

So it’s pretty safe to say that it is possible to receive over $1,000 in value just from the sign-up bonus alone.

Benefit sand User Perks

Now for a card that cost less than $100 a year the benefits included with this card are actually pretty decent.

And if you are able to spend at least $20,000 on the card within a calendar year (January 1 through December 31) it is possible to earn a $100 statement credit and 10,000 bonus miles.

This is worth $150 in total, which covers the cost of the annual fee and leaves you with about $50.

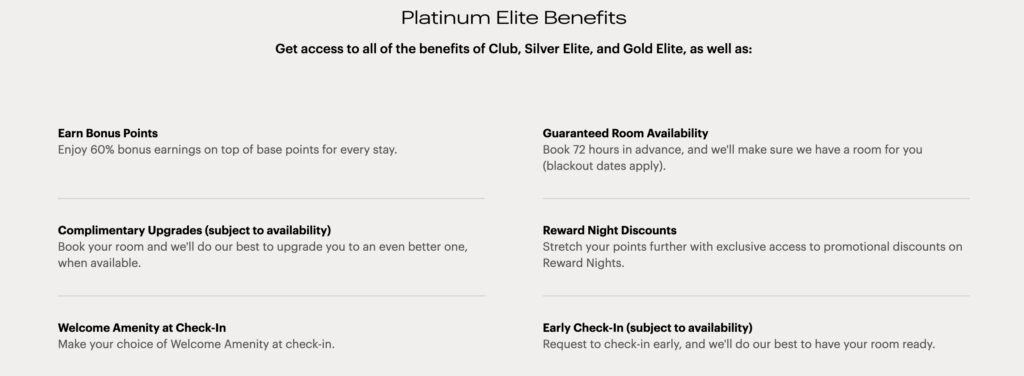

Now with this card, you automatically receive IHG Rewards Platinum Elite status, and this provides you with a few nice benefits.

The first one is an Anniversary Free Night, basically, this can be used at any IHG hotel and it has a value of up to 40,00 points per night, which is worth $200 based on points being worth 0.5 cents.

Then if you redeem points for 4 consecutive nights or more at an IHG hotel you will only be charged for 3 nights.

So technically the 4th night is free, and this can be quite valuable if you do happen to stay at a relatively expensive hotel.

Then finally with IHG Platinum Elite Status, it is possible to receive a 20% discount on any reward points that are purchased using the card.

There is then a $100 credit that can be used for either Global Entry, TSA PreCheck, or NEXUS.

Now with this benefit if you don’t plan to get NEXUS, make sure to get Global Entry as it also includes TSA PreCheck, whereas if you choose just to get TSA PreCheck, you will not get Global Entry.

And finally, there is a complimentary one-year DashPass which is worth $96 a year.

Points earning potential

Now when it comes to earning points, the IHG Rewards Premier card has the ability to earn a ton of points if you use the card to pay for the highest points earning categories.

So this card has a large bonus multiplier for IHG stays, basically when using the card to pay for any IHG hotel stays it is possible to earn up to 26x points per dollar spent

And this works out as follows:

- 10x points when using this card

- Then up to 10x points for being an IHG Rewards member

- And finally an additional 6x points for having Platinum Elite Status.

So if you spent $10,000 at IHG hotels over the course of a year you could receive up to 260,000 points which would be worth $130.

After this, it is possible to earn 5x points for any purchases made on travel, dining, or at gas stations.

Then all other purchases that are made on the card will earn 3x points per dollar spent.

So as you can see there is the ability to earn quite a lot of points from a reasonable range of categories, and if you do spend and stay at IHG hotels the pints earning potential is really good.

Insurance Protection

Now in terms of insurance coverage, the IHG Rewards Premier card has a few decent coverage options that can potentially save you a lot of money if you do ever need to make a claim.

With Trip Cancellation/Trip Interruption Insurance it is possible to receive coverage of up to $5,000 per person and a total of $10,000 per trip if your trip happens to be canceled or cut short for a covert reason.

Similar to this is Baggage Delay Insurance which provides you with up to $100 a day for 3 days if your luggage is delayed for more than 6 hours by a passenger carrier.

Then if your luggage is actually lost by the carrier you are covered for up to $3,000 per passenger with Lost Luggage Reimbursement.

And then finally there is Purchase Protection which provides you with up to 120 days of coverage for new purchases against damage or theft, and this covers up to $500 per claim and a total of $50,000 per account.

Annual Fee

Now considering the large sign-up bonus and a decent amount of benefits and user perks, this card is really quite affordable as it only costs $99 per year.

Just the anniversary free night benefit easily covers the cost of the annual fee and leaves you with at least another $100 in value.

APR

Now it’s worth going over what the Current APR is for this card and what fees are applicable if you happen to make a late payment.

So the APR for both purchases and making a balance transfer is currently between 20.24% to 27.24%.

And with a balance transfer, there is a fee of either $5 or 5% of the amount of each transfer.

A cash advance has an APR of 29.24% and also carries a slightly higher fee of either $10 or 5% of the amount of each cash advance.

Making a late payment or having a payment returned by your bank will incur a fee of up to $40 each.

It will also put you on a penalty APR of 29.99%.

Final thoughts

So that pretty much covers everything there is to know about the IHG Rewards Premier credit card, and in my opinion, it really does offer a lot of value for a credit card that costs less than $100 a year.

The sign-up bonus alone is worth at least $1,000 and as I showed you at the beginning of the video it can provide you with a nice stay at a decent hotel for at least a few days.

Then there is the ability to earn up to 26x points when staying at IHG hotels, which can really help you to earn a ton of extra points, and then finally the free anniversary night is a nice added extra that can save you around $200 each year.

Now if you would like to learn more about 3 of the best hotel reward credit cards available in 2023, check out this article here.