by Daniel | Last Updated Dec 6th, 2022

We may earn a commission for purchases using our links, at no cost to you.

In this article, I’m going to show you how you can easily increase your credit score to over 800 in the quickest and easiest ways possible.

Contrary to what you might think, it’s not actually that hard to dramatically increase your credit score within a relatively short period of time.

How Is Your Credit Score Determined?

So before I go over how to actually increase your credit score it’s really quite important to understand what actually determines your credit score.

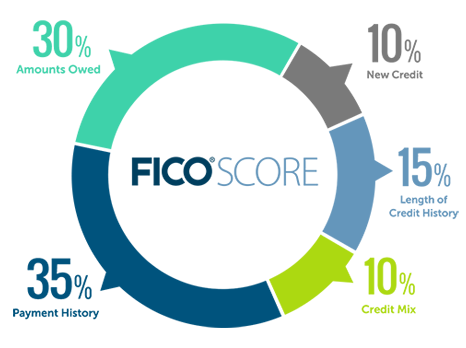

A commonly used metric is a FICO Score, which is basically the same as your credit score.

And this is comprised of 5 separate factors that ultimately make up your FICO score.

- The most influential and largest factor to be aware of is your Payment History, which makes up 35% of your total FICO score.

- Then the second largest factor is Amounts Owed, which makes up 30% of your total FICO score.

- Length of Credit History accounts for 15%.

- Credit Mix accounts for 10%,

- Then finally, New Credit also accounts for 10%.

So breaking down these factors is pretty straightforward.

Payment History 35%

Starting first with Payment History which makes up 35% of your FICO score basically, this shows how you’ve actually paid off your accounts over the length of your credit history.

And this is an extremely effective predictor of your ability to actually make payments on time and consistently, which is why it is one of the most important factors to consider with your own account.

Simply put, always pay off any amounts owing as soon as possible to avoid any late fees and to keep your credit score happy.

Amounts owed 30%

Accounting for 30% of your FICO score is then Amounts Owed.

And this is also an extremely important factor to be aware of if you want to have a high credit score.

It simply comes down to how much money you owe on your credit card or how much debt you might be carrying.

According to FICO research, the level of debt you carry is predictive of future credit performance.

So it’s best to try and keep the amount of debt you owe as low as possible, as using a large portion of your available credit will negatively affect your Credit Utilization ratio and therefore push your credit score down.

And the reason having a large amount of debt can be seen as a negative is that it can indicate to lenders and credit card issuers that you may be overextended and unable to make the required payments to keep your account in check.

Length of Credit History 15%

Now Length of Credit History is another important factor that actually makes up 15% of your FICO Score.

Although it won’t make or break your overall FICO Score, it is still worth being aware of.

Basically, it comes down to the following points:

- How long all of your credit accounts have been open, this will include your longest-standing account and shortest-standing account and then the average age of all your accounts combined.

- And then how often you use each account.

Credit Mix 10%

Accounting for 10% of your FICO score is your credit mix.

This basically takes into account different lines of credit that you might have.

It can include credit cards, auto loans, student debt, or even a mortgage.

Now if you only have one line of credit such as a credit card, that is totally fine and shouldn’t really impact your FICO score that much.

New Credit 10%

So last but not least is New Credit which makes up 10% of your FICO Score

This could be any new credit cards you may have applied for over the past 12 months.

And this can sometimes be a bit of a problem if you apply for too many credit cards in a short period of time.

As credit card inquiries can stay on your credit report for up to 2 years, applying for multiple credit cards in less than 12 months can actually lower your credit score as it will basically lower the average age of your accounts.

How To Become An Authorized User

So one of the easiest and quickest ways to improve your credit score is to become an authorized user.

Now, this isn’t always possible for everyone as you do actually need to know someone that has a good credit score and is willing to add you as an authorized user to their account.

So for example this could be a family member or a good friend.

Now it’s important to know that if your friend or family member actually agrees to add you to their account, they as the primary account holder will then be legally responsible for all credit card repayments that are made to the card, and this can potentially be quite a risky endeavor for them.

So a simple way around this would be to just have your name put on to their account but not receive an actual credit card.

This will avoid any issues for the primary account holder and still provide you with the benefit of being on their account.

Now as simple as this may sound it is extremely important to make sure that the account you are being added to actually has a good credit score, low credit utilization, and a good history of making payments on time.

So if you do choose to become an authorized user it is important that you contact the lender or credit card issuer to make sure that they will actually report all information regarding the credit card in use to all three of the major credit reporting agencies which are:

- Equifax

- TransUnion

- Experian

This is imperative because If they don’t report this information to the Credit Reporting Agencies, your credit score won’t improve at all.

Get A Secured Credit Card

Now another way of building up your credit score and establishing a good credit history is to get a secured credit card.

This is particularly useful if you have been deemed a high-risk borrower or have little to no credit history.

So to actually get a secured credit card the credit card issuer or lender will almost always require you to make a cash deposit which can be anywhere from $200 all the way up to $5,000 or more.

This money will then be placed into a savings account and in return, the card issuer or lender will provide you with a similar credit limit to the amount that is placed into the savings account.

Now once you have a secured credit card organized the best way to start building your credit score is to make sure that you always pay off any amount owing as soon as possible, and definitely before the due date each month.

If you fail to make timely payments and max out a secured credit card the credit card lender will basically just keep the initial deposit that was placed into the savings account, and needless to say, your credit score will most likely take a hit.

Make Sure Your Credit Utilization Is As Low As Possible

Now if you already have a credit card and don’t need to become an authorized user or get a secured credit card make sure that your credit utilization ratio stays as low as possible.

Generally speaking anything under 30% is considered pretty good, but if you can manage to keep your credit utilization ratio around 10%-20%, this will be even better.

As I mentioned at the start of this video, amounts owed account for 30% of your FICO score, so by keeping your credit utilization ratio nice and low, it is more than likely that it will result in a positive increase in your credit score.

So one easy way I keep my credit utilization ratio extremely low is by constantly paying off any amount that is owed on my credit cards.

And this has worked quite well for me as my credit score has been over 800 for more than 5 years now.

Now the benefits of having a low credit utilization ratio are really quite valuable.

The first and most obvious benefit is that your credit score will go up.

Along with this, it will make it easier to acquire additional credit at lower rates for things such as credit cards, auto loans, or even a mortgage.

And the reason for this is pretty straightforward, by having a low credit utilization ratio potential lenders will be able to see that you are not under any immediate financial stress and that you are actually managing your credit in a satisfactory way.

Don’t Make Too Many Credit Inquiries

So one thing that can negatively affect your credit score is making too many credit inquiries in a short period of time.

And it’s important to understand that there are actually 2 types of credit inquiries, a hard inquiry, and a soft inquiry.

An example of a soft inquiry would be checking your own credit score or if you authorized a potential employer to check your credit report.

In these two examples, as long as there is no new application for credit made, it will be a soft inquiry.

Now a hard inquiry is usually associated with getting a new line of credit, which could be anything from a mortgage, auto loan, or new credit card.

Basically, a creditor will make a request to view your credit files so they can determine if you pose any risk to them as the borrower.

Hard inquiries will show on your credit report for up to 2 years and can negatively affect your credit score in the short term, which is usually a few months.

Check For Credit Errors On Your Account

Now another relatively easy way to potentially help boost your credit score is by checking your personal accounts and credit report for any errors that may have been made.

This could easily happen if your bank made a simple mistake or if a credit card scammer managed to find and use your information.

An easy way to check for this is to always go over your billing statement on a weekly basis to make sure there are no unusual charges that have been made to your account.

If you do happen to see anything out of the normal simply notify your card issuer as soon as possible and they should help you to resolve the issue relatively quickly.

Now in terms of checking up on your credit report the website :

AnnualCreditReport.com is a great place to start as it is free to use and is authorized by federal law.

Basically, they gather information from all three major credit bureaus and also have access to a large database of your credit use.

Now if you do find any errors on your credit report it is possible to dispute them.

This can be done by contacting any of the three credit bureaus by phone or by sending them a letter.

And I’ve left a link to each of the three credit bureaus’ dispute pages in the description below.

- https://www.equifax.com/personal/credit-report-services/credit-dispute/#

- https://www.experian.com/ncaconline/dispute

- https://www.transunion.com/credit-disputes/dispute-your-credit

Apply For A Credit Limit Increase

Now another possible way to help increase your credit score is to apply for a credit limit increase.

And what this does is effectively increase the amount of available credit that you have on your credit card, which will then usually lower your credit utilization ratio, which as I mentioned before, is a factor in determining what your credit score is.

And if you want to learn how to get a credit limit increase check out this article here.

Now if you do choose to get a credit limit increase, it is extremely important to be mindful of staying on top of your payments and still aiming to keep your credit utilization ratio below 30%.

Just because you have access to more credit, it doesn’t mean you should use all of it.

And remember that applying for a credit limit increase can result in a hard inquiry on your credit report which may well negatively affect your credit score for a few months.

It will also stay on your credit report for two years.

Final Thoughts

So that covers a few simple ways you can quite easily and effectively increase your credit score to 800 or above.

And remember that having a good credit score is extremely important as it really can make a huge difference to the amount of interest you pay on any borrowed money.

Now if you are relatively new to credit cards and want don’t want to make any common mistakes, I recommend that you check out this article here where I talk about common credit card mistakes that you should avoid.