by Daniel | Last Updated Jul 25th, 2023

We may earn a commission for purchases using our links, at no cost to you.

When it comes to travel-related credit cards, American Express has some fantastic options to choose from.

And at the top of the list, there are two specific cards that stand out, the Delta SkyMiles Reserve card and the Marriott Bonvoy Brilliant card.

Whether you’re a seasoned globetrotter or relatively new to travel reward credit cards, these two cards offer a fantastic combination of benefits that will provide you with outstanding value.

In this article, I’ll uncover their incredible sign-up bonuses, delve into the exclusive perks they provide, and demonstrate how this well-matched pair can unlock a treasure trove of value.

What Are The Signup Bonuses Worth?

Now getting a good sign-up bonus can really help to increase the amount of value you receive from a credit card, and at the time of making this video, both of these cards have a limited-time offer where you can earn substantially more value than normal.

The Amex Delta SkyMiles Reserve Card Is currently offering the ability to earn 85,000 bonus miles after you spend $6,000 on purchases within the first 6 months of opening the account.

This works out to be just $250 a week or $1,000 per month over the first 6 month period of card ownership.

Now with Delta Skymiles being valued at 1.2 cents per mile, this sign-up bonus is worth $1,020.

TakeOff 15

Now another nice benefit worth mentioning that comes with this card is the ability to receive a 15% discount on Delta-operated flights when using your own Delta SkyMiles to make a booking, and this benefit is called ’TakeOff15’

This can really help you extract even more value from your hard-earned Miles.

And to take advantage of this benefit you will need to book your flights through either the Delta Website or app.

Then, once you are online just log in to your SkyMiles account and choose ‘Shop with Miles’.

But just note that this discount is only available to primary cardholders, not authorized users.

So let’s now take a look at how you could redeem the sign-up bonus miles through Delta.

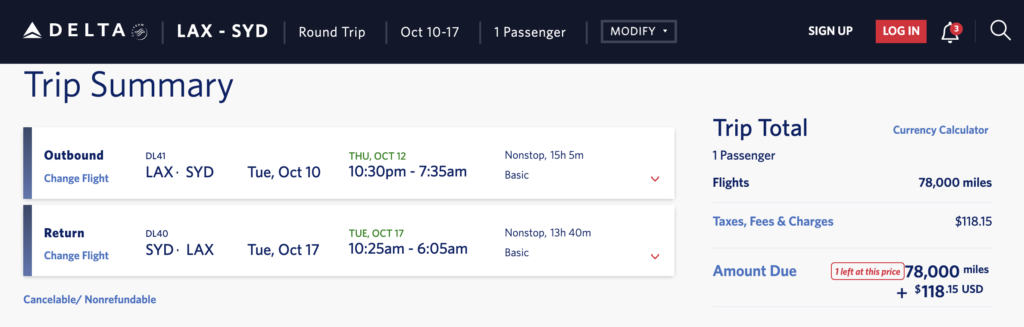

As an example, you could book a return flight from LAX to Sydney Australia for 78,000 miles plus $118.15 in taxes and fees.

And because you get 15% back when using your own Delta SkyMiles you will receive 11,700 SkyMiles back, so it will cost a total of just 66,300 SkyMiles.

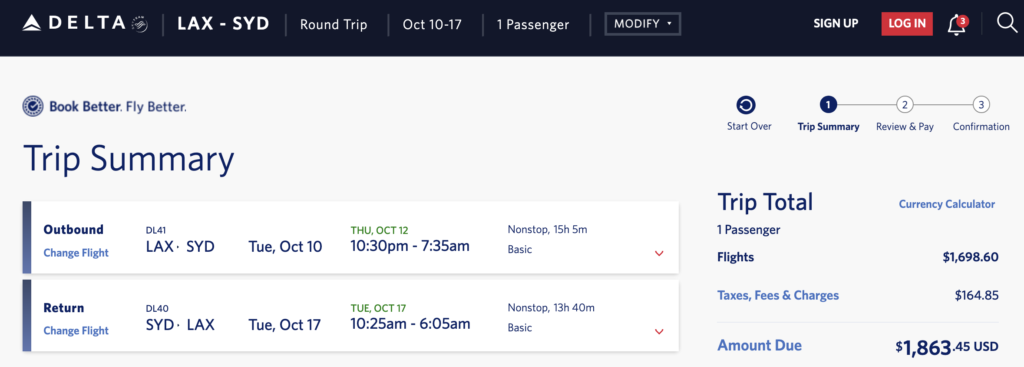

Now if you were to pay for the same exact flight it would cost you a total of $1,863.45.

So if we minus the $118.15 in taxes and fees from the $1,863.45 flight fee, you are left with a value of $1,745.30 or just over 2.6 cents per mile, which is fantastic value.

Not to be outdone, the Marriott Bonvoy Brilliant card is also offering a fantastic sign-up bonus of 150,000 Marriott Bonvoy Bonus Points after you spend the same $6,000 on purchases within the first 6 months of card ownership.

And that’s not all, if you manage to stay 6 eligible paid nights at any hotels that are participating in Marriott Bonvoy before the 23rd of August 2023, it is possible to earn an additional 50,000 bonus points.

Now with Marriott Bonvoy Points being valued at 0.8 cents per point, the 150,000 point signup bonus is worth $1,200.

And then if you manage to take advantage of the additional 50,000 bonus points by staying 6 nights at a Marriott Property, the total value of the sign-up bonus will be $1,600.

Now Marriott Bonvoy points can be exchanged for luxurious stays at over 8,500 hotels worldwide. From cozy retreats to opulent resorts, your choices are virtually endless.

Stay for 5, Pay for 4

Now something you should know is that Marriott has the option to use Marriott Bonvoy Points to get your 5th night free when redeeming your Marriott points to pay for 5 or more consecutive nights at the same Hotel.

This offer is called ‘Stay for 5, Pay for 4’, and it can be used for stays that are in increments of 5 days, so if your stay was 10 days long, you get 2 days free, and so on.

As long as the nights are back-to-back at the same hotel you will receive this benefit.

And this is a fantastic way to really extract as much value out of your points as possible.

So let’s take a quick look at where you could stay with these points and how much value is available.

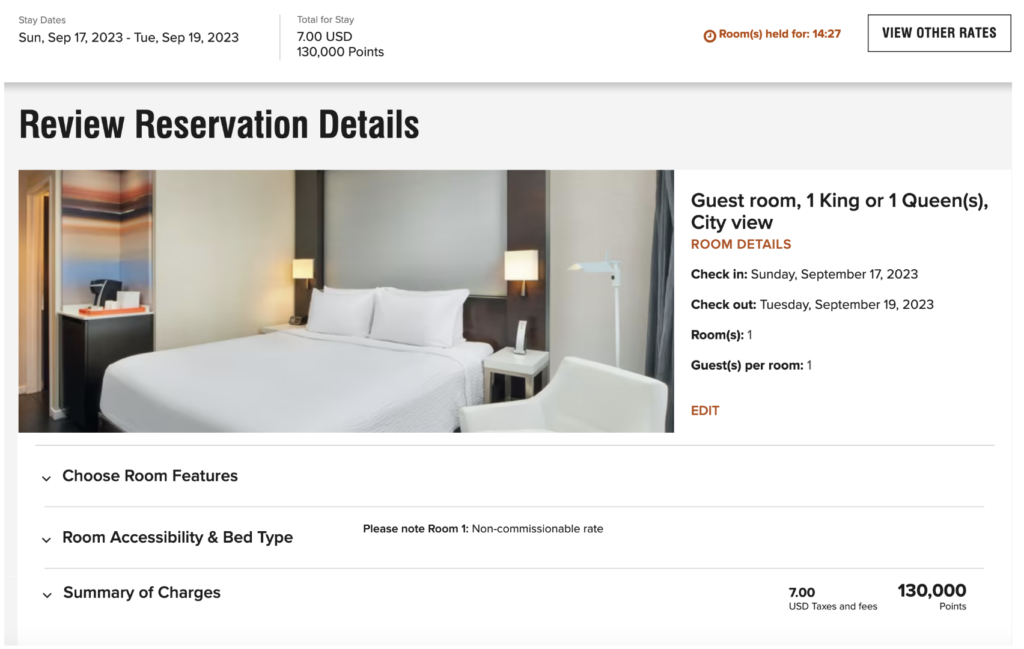

Assuming you just get the 150,000 bonus points, you could book two nights at the Courtyard Marriott hotel in New York for a total of 130,000 points plus $7 in taxes and fees.

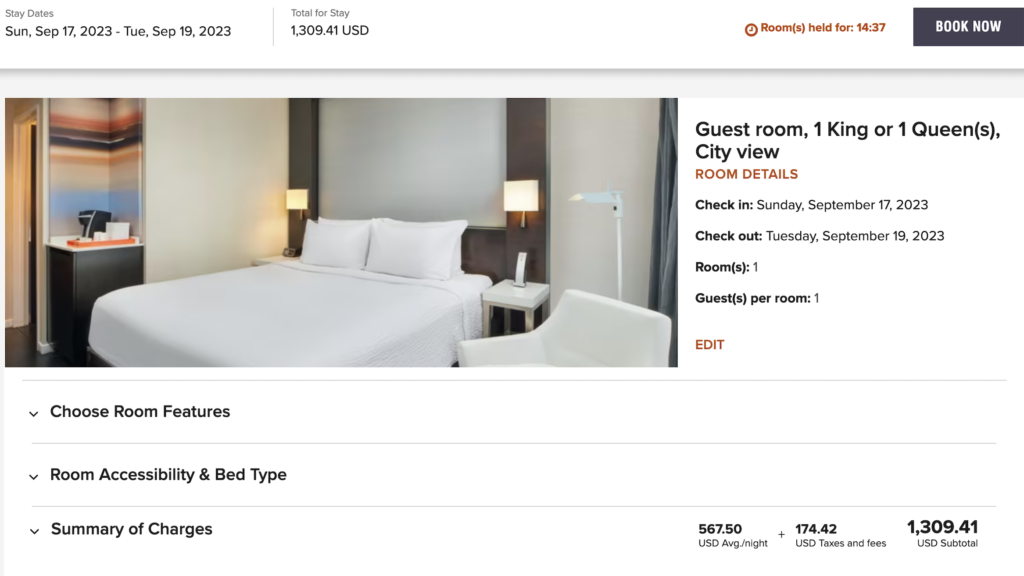

Now if you were to pay for the same room in cash it would cost you a total of $1,309.41.

This is a points value of about 1 cent per point which is pretty decent.

Exclusive Benefits And Perks Of Each Card

Now in my opinion, traveling should be a pleasure, not a pain, and with both of these cards combined, you are really opening up the door to some fantastic opportunities and convenience that will make your travel more enjoyable.

So as I mentioned earlier, with the Delta SkyMiles Reserve Card you receive the TakeOff15 benefit which basically provides you with a 15% discount on flights when using your own Delta Skymiles, and this really can help you to get a lot more value from your SkyMiles.

But the most valuable benefit that is included with this card is the Delta Reserve Annual Companion Certificate.

This provides you with a free domestic First Class, Comfort+, or Main cabin round trip fair each year.

Just note that this benefit is only available to you after you renew the card for a following year of card ownership.

And needless to say, this benefit can be really quite valuable, it can save you literally thousands of dollars each year.

If you want to learn more about how to use the Delta SkyMiles companion Certificate, check out this article here.

Now another really nice benefit to have that comes with this card is the ability to gain complimentary access to both the Amex Centurion Lounge and the Delta Sky Club when you are traveling on a Delta-marked flight.

This is a really nice benefit to have as you will have access to free food and beverages and somewhere to relax before your flight.

Along with this, each year you will receive two Delta Sky Club One-Time Guest Passes, which will allow you to bring two friends into the lounge free of charge.

And seeing that entry into the Delta Sky Club costs $50 per person, just this benefit alone is worth $100.

Now when you fly on Delta-marked flights you will receive your first checked bag free of charge, along with this you also receive Main Cabin 1 Priority Boarding which allows you to board the plane a lot earlier.

Then once you are on the flight you will also receive 20% back for any inflight purchases of food, beverages, or audio headsets.

Now If you manage to spend $25,000 on the card within a 12-month period it will be possible to waive the Medallion Qualification Dollar Requirement for either Silver, Gold, or Platinum Medallion Status.

Then finally you will receive a $100 credit that can be used for either TSA Pre-Check or Global Entry.

So as you can see, with the Delta SkyMiles Reserve Card there is a ton of fantastic benefits on offer that can make your travel a whole lot more enjoyable.

Now with the Marriott Bonvoy Brilliant card, there are some equally impressive benefits on offer that will provide you with a lot of value.

And one of the most valuable benefits that comes with this card is the Free Night Award which can be used at a Marriott Property that has a redemption value of up to 85,000 points.

And seeing that Marriott Bonvoy points are worth 0.8 cents per point, this benefit is worth around $680.

Then if you manage to spend $60,000 on this card within a calendar year you will have the choice to choose one of the 3 following benefits from the Brilliant Earned Choice Award.

There are :

- Five Suite Night Awards

- A Mattress and Box Spring $1000 Discount from Marriott Retail Brands

- One Free Night Award with a redemption value of up to 85K points

Now another nice benefit that is really quite easy to use with this card is a $300 Dining Statement Credit that is provided to you in $25 monthly allotments and can be used at restaurants worldwide.

There is then complimentary Marriott Bonvoy Platinum Elite status that allows you to earn more points and room upgrades when they are available.

And you will receive 25 Elite Night Credits each year that can help to bring you to a higher level of elite status.

Now if you book a stay of two nights or more at either the Ritz Carlton or the St Regis you will receive a $100 Marriott Bonvoy Property Credit.

And this can be used on things such as room service, dining, or spa services depending on the property.

Then finally, just like the Delta SkyMiles Reserve Card you will receive a $100 credit that can be used for either TSA PreCheck or Global Entry.

So between the two cards, you can save literally thousands of dollars on flight and hotel stays each year.

Earning Points and Miles

So another really important factor of a good credit card is its ability to earn points or miles from everyday spending.

This can really help to provide you with a ton of extra value and essentially allow you to travel for free!

So with the Delta SkyMiles Reserve Card, there are two options for earning miles.

The first is the ability to earn 3x miles on purchases that are made directly with Delta.

Then all other purchases that are made on the card will earn you 1 mile per dollar spent.

Now with the Marriott Bonvoy Brilliant card, there are quite a lot more options for earning points.

The first is the ability to earn 6x points for stays that are booked at Marriott Bonvoy properties.

You will then earn 3x points at restaurants worldwide and for flights that are booked directly with airlines.

Then finally all other purchases that are made on the card will earn you 2x points.

Now seeing that you also receive complimentary Marriott Bonvoy Platinum Elite status with this card you will actually be able to earn up to 21x points per dollar spent when you stay at a Marriott property.

This works out as follows:

- 6X points as a Brilliant cardholder

- Up to 10X points because you’re a Marriott Bonvoy member

- Then up to 5X points as part of the 50% Bonus Points awarded for having Platinum Elite Status.

Now finally it is also possible to transfer Marriott Bonvoy points to 39 different partner airlines at a rate of 3:1 (for most airlines)

Then each time you transfer a minimum of 60,000 Marriott Points to Miles, you will receive 5,000 bonus miles.

And if you happen to be a United MileagePlus member you will receive 10,000 bonus miles for every 60,000 points transfer And if you happen to be a United MileagePlus member you will receive 10,000 bonus miles for every 60,000 points you transfer to United.

So the Marriott Bonvoy Brilliant Amex card does offer more value in the way of Points earning potential than the Delta SkyMiles Reserve Card does.

What Insurance Coverage Do You Receive With Each Card?

Now having insurance coverage with your credit card is a really nice benefit to have, it can provide you with peace of mind and potentially save you a lot of money if anything does happen to go wrong.

And both of these cards are almost identical in what they offer.

So both cards have the same Car Rental Loss and Damage Insurance that covers up to $75,000 in the event of an accident and this is secondary coverage.

Then both cards offer cell phone protection that covers you for up to $800 per claim with the ability to make 2 claims per year.

And each claim will incur a $50 deductible fee.

All you need to do is make sure you charge your monthly cellphone bill to your card.

Now you will also receive Trip Delay insurance which provides you with up to $500 per covered trip if it is delayed for more than 6 hours.

And this allows for a maximum of 2 claims per 12-month period.

Then both cards offer Trip Cancellation/Interruption insurance that covers up to $10,000 per covered trip and $20,000 per card per 12-month period.

There is Purchase Protection with both cards which provides 90 days of coverage for new purchases against damage or theft.

And this covers up to $10,000 per covered purchase and a total of $50,000 per card per year.

Both cards also offer the same extended warranty protection of 1 additional year of coverage on warranties that are 5 years or less.

And this covers up to $10k per covered purchase and a total of $50k per card per year.

Then finally the only main difference between the two cards is the Baggage Insurance Plan.

With the Marriott Bonvoy Brilliant card, you are covered for up to $2,000 for checked baggage, and up to a maximum of $3,000 for checked and carry-on luggage combined.

Whereas with the Delta SkyMiles Reserve Card, the coverage is for up to $1,250 for carry-on and $500 for checked baggage.

Final Thoughts

Ok, so that covers just about everything there is to know about both of these cards, and as you can see they both offer a ton of value and provide you with a lot of nice benefits when it comes to traveling.

Now even though both of these cards are relatively expensive on an annual basis, with the Reserve card costing $550 and then the Brilliant card costing evening more at $650.

it is actually possible to receive way more value back from both of these cards each year assuming you take advantage of a majority of the benefits when you do travel.

Both cards offer over $1,000 just from the signup bonus alone, and then when you include the benefits on offer you are looking at even more value.

Now if you enjoyed the article make sure to check out my review of the Ultimate Credit Card of 2023.