by Daniel | Last Updated September 12th, 2023

We may earn a commission for purchases using our links, at no cost to you.

So not long ago I reviewed the Delta SkyMiles Reserve Card and Marriott Bonvoy Brilliant card and came to the conclusion that this credit card combo was the Ultimate Amex Travel Combo, but due to the high annual fees of both of these cards I believe I have found two very similar Amex Travel credit cards that are substantially cheaper on an annual basis but offers just about the same amount of value.

These to cards are the Delta SkyMiles Platinum Card and the Hilton Honors Aspire card.

So what, if any are the big differences between these two credit card combos?

Well, let’s jump straight in the video and see what exactly you get with this far cheaper credit card combo.

Annual Fee and Sign-up Bonus

So let’s start by looking at what each card cost on annual basis and what the current sign-up bonus is.

And these are obviously important factors to consider when choosing a new credit card.

With high annual fee credit cards although you generally receive more benefits and a larger sign-up bonus, it’s worth considering if you will actually utilize all of the benefits that are on offer.

As if you don’t, you are more than likely paying an unnecessary amount of money for a credit card that is not being fully utilized.

This is where these two cards come in to focus and start to make more sense.

So starting first with the Delta SkyMiles Platinum Amex card you are looking at an annual fee of $250, and this is substantially less than what the top of the line Delta SkyMiles Reserve Card cost, which is $550 per year, or $300 more.

And you will see later in this video that you actually get a very similar amount of benefits and value from the cheaper Platinum card.

Now with the Hilton Honors Aspire card the annual fee comes in at $450 a year, and compared to the Marriott Bonvoy Brilliant card which is $650 a year, you are looking at a $200 saving each and every year.

And just like the Delta SkyMiles Platinum, this card offers comparable value to the Marriott Brilliant card for a fraction of the cost.

So taking this all in to account, your are looking at a $500 saving with the cheaper Aspire and Platinum card combo compared to the Reserve and Brilliant card combo, which is a decent amount of money!

Sign-up Bonus

Next up, let’s take a look at what sign-up bonus is currently on offer with each card.

And starting first with the Delta SkyMiles Platinum card, at the time of making this video it impossible to earn 50,000 Bonus miles if you manage to spend $3,000 on purchases within the first 6 months of opening the account.

And interestingly enough it’s not that much different to what the Reserve card is currently offering which is 60,000 bonus miles after you spend $5,000 within 6 months.

So its not a deal breaker difference in my opinion.

Now with Delta SkyMiles being valued at 1.2 cents per mile, this sign up bonus is worth $600 which is enough to cover the cost of the annual fee for just over 2 years.

And for interest sake, the Reserve cards 60,000 miles bonus is worth $720, so $120 more in value, but it will cost you $300 more for the annual fee

Now with the Hilton Honors Aspire card it is currently possible to earn 150,000 Hilton Honors Bonus Points after spending $4,000 on purchases within the first 3 months of opening the account.

Then in comparison the Marriott Bonvoy Brilliant card is currently offering for a sign up bonus of 95,000 Marriott Bonvoy bonus points after you spend $6,000 in 6 months.

And interestingly enough, the cheaper Hilton Honors Aspire card actually offers more value from its sign-up bonus with a small spend requirement to actually receive it.

With the Hilton Honors points being valued at 0.6 cents per point, its sign-up bonus is worth $900.

Then with Marriott Bonvoy Points being worth 0.8 cents per point, its sign-up bonus is only worth $760.

That’s $140 less in value for a card that costs $200 more for its annual fee.

So just taking the sign-up bonuses and annual fees of these two cheaper cards, you are already seeing better value than the more expensive Reserve card and Brilliant card.

Exclusive Benefits And Perks Of Each Card

Ok so now let’s take a look at some of the benefits and perks that are offered with both of these cards.

And starting first with the Delta SkyMiles Platinum card the most valuable benefit that comes with the card is its Annual Companion Certificate.

This basically provides with a complimentary return domestic flight that can book in the Main Cabin of a Delta flight.

In terms of value it is not uncommon to find return flights for upwards of $500 or more, so it’s a pretty good benefit to have.

Now there are a couple points to know about this benefit:

- It is only available to you once you actually renew your card for the following year, so you will need to wait at least 12 month before you can utilize this benefit.

- Also, when you do use this benefit you will need to pay for additional taxes and fees that are associated with the flight you choose, which are capped at $80.

Either way, this is still a really nice benefit to have, and the only main difference between this and the Reserve card is the fact that the Reserve card offers the ability to get a return Domestic flight in First Class.

So yes this is worth more than what the Platinum card is offering, but you can still technically travel on the same flight as the Reserve card, just not on First class, which for me, is not an issue at all seeing that most domestic flights in the US are not much longer than 5 hours, which is not really a very long flight.

Now if you do have a Delta SkyMiles credit card or are considering getting one, I recommend you read my article that details everything you need to know about the Delta Companion Certificate.

So now let’s take a look at one of the most valuable benefits that you get from the Hilton Honors Aspire card.

And this would be the Annual Free Night Reward, this basically gives you the ability to book a standard double occupancy room or ’Standard Room Reward’ booking.

Best of all it is available to you your first year of card ownership and each year there after.

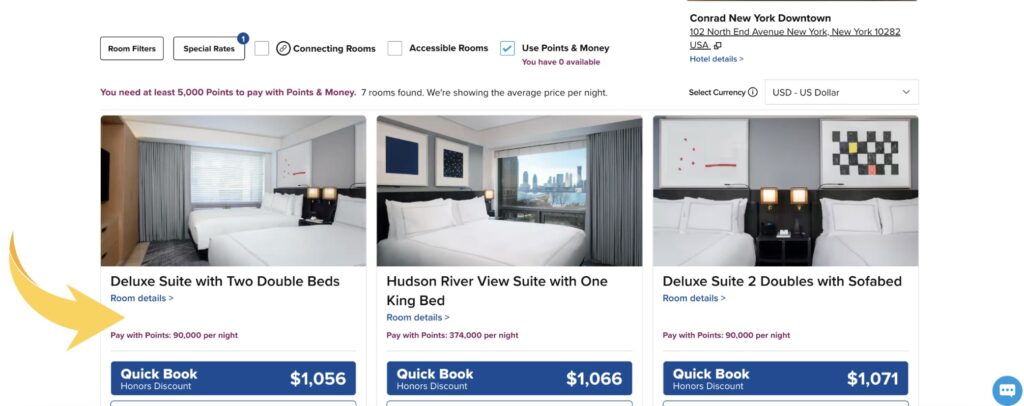

And in terms of value, as an example It is possible to book a free night at the Conrad New York Down Town which has the option to book a “Standard Room Reward” using this benefit.

And as you can see here there is a ‘standard’ room going for $1,056 per night (or 90,000 Hilton points).

So it can be a super valuable benefit to have depending on where and how you use it.

In comparison to the more expensive Marriott Bonvoy Brilliant card, which also offers Free Night Award, which Is valued at approximately $680, the Hilton Honors Aspire card benefit is worth at least as much if not more.

So just like the Delta SkyMiles Platinum card, both of these cheaper cards offer pretty much the same value up until this point of the review.

Now let’s just look at all of the other perks that are offered with both of these card.

Starting with the Delta SkyMiles Platinum card there is reduced rate entry into the Delta Sky Club which costs $50 per person for you and up to 2 other guests.

Now in my opinion this is not such a great offer to be honest as I don’t believe it is worth paying $50 to access the Delta Sky Club.

And this is something the the Delta SkyMiles Reserve Card actually beats out the Platinum card on as it offers you with complimentary access to the Delta Sky Club.

Although if you want to bring in any guests, it will still cost you $50 for each guest.

Now one thing the take in to account is that with the Hilton Honors Aspire card you will actually receive a complimentary Priority Pass Select membership which will make up for this, as it provides you with access to well over 1,200 different airport lounges around the world, which can in some cases be just a nice as the Delta Sky Club.

And if you already have a Priority Pass or are thinking about getting one, I encourage you to read my full in depth article where I detail everything you need to know about what Priority Pass can actually offer you.

Now the remaining benefits that are offered with the Delta SkyMiles Platinum card are:

- A $100 credit for either TSA PreCheck or Global Entry

- 20% Back on In-flight purchases on Delta

- Your first checked bag free on Delta Flights

As with this more expense Reserve card you will also receive the ‘TakeOff 15’ benefit.

This basically allows you to receive a 15% discount on Delta-operated award flights when using your own Delta SkyMiles.

Then finally, after you spend $25,000 on the card within 12 month period you will earn 10,000 MQMs, and this is available to you as a Platinum card holder 2 times per year, which means you are limited to earning a maximum of 20,000 MQMs each year.

So in comparison to the Delta SkyMiles Reserve card, it doesn’t offer as many perks but considering that fact it is $300 less per year for the annual fee makes up for this.

Now let’s just look at all of the other perks that are offered with the Hilton Honors Aspire, and interestingly enough, there is actually even more value to be had than with the Delta SkyMiles Platinum card.

So each year you will receive the following benefits:

- A $250 Hilton Resort Statement Credit

- Then a $250 Airline Fee Credit that can be used towards any incidental fees that are charged to you by an airline. Just note that you can only select one qualifying airline each calendar year, and this can be done from within your Amex account.

- You will receive a $100 Hilton On-property credit which can be used for bookings of two nights or more at either the Waldorf Astoria or any Conrad hotel, and this must be booked through hiltonhonorsaspirecard.com to be valid.

- As I mentioned earlier in this article, one of the most valuable benefit this card offers is an Annual Free Night Reward that can be used for one standard accommodation double occupancy room or ‘Standard Room Reward’ rate.

- Then if you manage to spend $60,000 or more on your account within a calendar year you will receive an additional Free Night Reward.

- And finally you will receive a Priority Pass Select membership that is worth $469 each year.

So as you can see there is plenty of value to be had with he Hilton Honors Aspire card, and in comparison to the more expensive Marriott Bonvoy Brilliant card you are receiving almost as much value for $200 less per year.

What is The Points and Miles Earning Potential Of Each Card?

Now let’s take a look at how and where you can earn miles and points from both of these cards.

And this is obviously an important factor to consider, as if you use each card effectively, you will end up earning a ton of extra miles and points.

And starting first with the Delta SkyMiles Platinum card you actually have more options for earning miles than with the more expensive Reserve card.

This break down is as follows:

- 3x miles on Delta purchases (must be made directly with Delta)

- 3x miles at hotels (must be made directly with hotels)

- 2x miles on dining, takeaway and delivery services from within the US

- 2x miles at US supermarkets

- Then all other purchases will earn 1 miles per dollar spent

So as you can see there are plenty of options for earning extra miles through everyday spending.

Now with the Hilton Honors Aspire there is an equally impressive points earning structure that allows you to earn a ton of extra points.

This break down is as follows:

- 14x points for eligible stays at Hilton Hotels & Resorts.

- 7x points for flights that are booked directly with an airline or through amextravel.com

- 7x points at select car rental companies

- 7x points at US based restaurants which includes take out and delivery services.

- Then all other purchases will earn you 3x points per dollar spent.

Now one very important factor to take into account is that because you receive complimentary Diamond status you will actually receive a 100% bonus on all base points.

And best of all, Diamond status is the top tier level that is offered by Hilton.

Basically this means that for every dollar you spend at Hilton properties, you will receive at additional 20 points (10 Base + 10 Bonus Points)

This is then added to the 14x points you already receive for bookings made at Hilton Properties, which means you will actually earn 34 points per dollar spent.

So needless to say, if you take advantage of this benefit on a regular basis you will earn a ton of extra points throughout the year.

What Insurance Coverage Do You Get?

So the last section we need out look at is all of the insurance coverage that is provided to you with both off these cards.

Both cards offer Car Rental Loss and Damage Insurance, with the Hilton Honors Aspire card it covers up to $75,000 in the event of an accident, whereas the Delta SkyMiles Platinum card offers just $50,000 in coverage.

And this is secondary coverage.

Both cards offer Purchase Protection, with provide you with 90 days of coverage for new purchases against damage or theft, with the Aspire card it covers up to $10,000 per covered purchase, whereas the Platinum card only covers up to $1,000 per covered purchase, although both cards have the same total coverage of $50,000 per year.

There is Extended Warranty coverage with both card that offers 1 year of additional coverage on warranties that are 5 years or less

With Trip Delay insurance the Aspire card covers up to $500 per cover trip if it is delayed by more than 6 hours, whereas the Platinum card offers just $300 if your flight is delayed by more than 12 hours.

And both cards allow for up to 2 claims per 12 month period.

Both cards offer a Baggage Insurance plan, with the Aspire card this covers up to $2,000 for checked baggage and $3,000 for carry-on baggage.

Then with the Platinum card this covers up to $1,250 for carry-on luggage and up to $500 for checked luggage.

Now only the Aspire card offers Trip Cancellation/Interruption insurance that covers up to $10,000 per covered trip and $20,000 per card per 12-month period.

Again only the Aspire card offers Return Protection which provides you with 90 days of coverage on new purchases that a merchant won’t take back, and this provides up to $300 per item and a total of $1,000 per card per year.

Then only the Platinum offers Cell Phone Protection that covers you for up to $800 per claim with the ability to make 2 claims per year, and each claim will incur a $50 deductible fee.

Final Thoughts

Ok, so that pretty much sums up everything there is to know about both of these cards, and as you can see there is huge amount of value to be had by combining both of these card.

And in my opinion this credit card combo is even better value than the Delta SkyMiles Reserve Card and Marriott Bonvoy Brilliant card combo that I reviewed a couple of months ago.

The fact that the combined annual fee of the Aspire and Platinum card is $500 less than what the Reserve and Brilliant card cost makes this Amex travel card combo at lot more enticing.

And best of all the benefits are are pretty much on par with the more expensive Reserve card and Brilliant card.

But more importantly, which card combo do you guys prefer? The Hilton Honors Aspire card and Delta SkyMiles Platinum card? or the more expensive and exclusive Delta SkyMiles Reserve card and Marriott Bonvoy Brilliant card?

And if you’re looking for something else interesting to watch, check out this video here where I show you a complete guide to using Priority Pass.