by Daniel | Last Updated January 27th, 2024

We may earn a commission for purchases using our links, at no cost to you.

So I got my Chase Sapphire Reserve card back in 2016 when it first released.

And back then it was offered with a 100,000 point signup bonus which was amazing value.

Now after 8 years of card ownership, does the Chase Sapphire Reserve card still provide me with enough value to justify paying the $550 annual fee?

Well, let’s take a look at a few things that I like (and dislike about this card) to see if I should keep it or can it.

Now as I just mentioned before the annual fee associate with this card is currently $550, and whilst this is not a horrible amount of money, it is still enough to turn a lot of people off even considering this card.

And seeing that you can get the Chase Sapphire Preferred card for just $95 a year, why do I still choose to pay $550 for a similar card?

What I Like

And this brings me to one of the first things I really like about this card that helps me justify paying the $550 annual fee each and every year, and this is the $300 annual travel credit.

And just incase you didn’t know, it is actually very easy to make use of this benefit with the Reserve card, much more so than $300 Travel Credit that comes with the Capital One Venture X card.

As with that card you can only claim the $300 travel credit for bookings that are made through the Capital One Travel Portal.

However, with the Chase Sapphire Reserve card all you need to do is use the credit card to make a direct payment to a qualifying travel related category to receive the credit.

And seeing that there is such a wide range of travel related categories that qualify for the credit, it’s almost hard not making use of this credit.

I mean just look at the options you have here on their website for the travel credit, you have: airlines, hotels, motels, timeshares, car rentals, and then trains, buses, taxis, limousines, ferries, and toll bridges.

So again, it is a pretty extensive list that is pretty easy to take advantage of.

And this then brings the annual fee down to a much more reasonable $250 a year, which makes it a lot more desirable, and easier to justify.

Although, it’s still $155 more than the Preferred card on an annual basis, but I’ll get to that a little later in the article.

What I Dislike

Now as much as I really like the $300 annual travel credit, there was one thing that caught me off guard with the Chase Sapphire Reserve card just a couple of months ago that I really didn’t like.

So as I travel a lot through out the year for my second YouTube Channel which an in the automotive niche, I hire quite a lot of cars through the car sharing app Turo.

And if you don’t know what Turo is, basically it a similar Idea to what Airbnb is, but for cars, – so people like you and me can essentially rent out our cars and make an income from it.

Now what happened to me is really my own fault as I didn’t fully understand the Auto Rental Collision Damage Waiver that is offered with the Chase Sapphire Reserve card.

So on the Chase website it sates:

“Decline the rental company’s collision insurance and charge the entire rental cost to your card. Coverage is primary and provides reimbursement up to $75,000 for theft and collision damage for rental cars in the U.S. and abroad.“

Now I just assumed this covered cars that I rented from Turo, as I assumed out was the same as rental company, but I was wrong.

So what happened is, I hired an Audi RS6 (which is a pretty expensive car) and I chose the minimum coverage on Turo, which is the most cost effective insurance option they offer.

And this has a $3,000 max out-of-pocket expensive if something goes wrong.

So I just assumed if something did go wrong, Chase would cover this expense.

And something did go wrong, one night when the car was parked, someone damaged the rear end of the car as you can see in the picture below.

And whilst it wasn’t to bad, you’ve got to expect that it will be quite costly being an Audi.

So I called up Chase as I used my Reserve card to book the car, and they basically told me that they don’t offer the Auto Rental Collision Damage Waiver for Car Sharing Platforms like Turo.

Now obviously I was a bit annoyed about this so I decide to go over the ‘Guides To Benefits’ for the Chase Sapphire Reserve card.

And in the Auto Rental Collision Damage Waiver section under the section ‘what they don’t cover’ it clearly states: Vehicles that are not rented from a Rental Agency.

And then a little further down under definitions it states:

Rental Agency: a commercial rental company licensed under the laws of the applicable jurisdiction and whose primary business is renting automobiles

So seeing that I wasn’t covered by Chase I basically ended up covering the cost of the damage to the car out of pocket, which was not as bad as I thought it might be.

But lesson learnt, I will always choose the full insurance option on Turo in the Future.

So that is one thing I don’t like about this card, even though it’s my own fault for not fully understanding their terms and conditions.

Now I think it would be nice if they did include Turo in their Auto Rental Collision Damage Waiver, as I think that it is a much better service than pretty much any other car rental agency out there.

What I like

So let’s get back to another thing that I really like about the Chase Sapphire Reserve card.

Now as I mentioned before I travel a lot throughout the year, which means I spend quite a lot of time at airports all over the world.

And this makes the next benefit I get with my Chase Sapphire Reserve card really quite valuable to me.

And that is the complimentary Priority Pass Select membership which is worth at least $469 each year (at least that is what they charge on their website for a similar membership).

Now as you may know, there are quite a few credit card companies in the US that offer a commentary Priority Pass membership as one of their perks.

But what you might not know is that these membership actually vary in what benefits you are actually entitled to.

Basically, the Priority Pass Select membership that comes with the Chase Sapphire Reserve card offers the all of the available benefits, making it quite valuable.

So this includes lounge access for me and 1 guest totally free of charge to over 1,500 airport lounges all over the world.

And I use this befits the most as there is usually a lounge at most airports I travel through.

Now if there isn’t an airport lounge I can use the restaurant credit, where I can bring along one friend and claim up to $60 off our bill at a participating restaurant or cafe.

Now there isn’t as many restaurants options as airpot lounges available, but its a nice benefit to have.

Then if I have some extra time at the airport and they have the facility, I can get a free massage at a Be Relax Spa.

I did this last time I was LAX and got a free 30 mins massage that was valued at $38.

And it was really quite nice!

So the Priority Pass benefit that comes with the Reserve card more than makes up for remaining $250 annual fee (at least for me).

What I Dislike

Now another thing that I’m not that fond of that comes with the Chase Sapphire Reserve card that I think could be changed is the $100 credit you receive for use on either Global Entry, TSA PreCheck or NEXUS.

Now I don’t want to complain to much about this as it can sometimes be useful, but in my experience, its seem that so many people now have TSA PreCheck or Global Entry, that it really doesn’t make that much difference in the the time it takes to clear security at the airport.

And I know this isn’t directly a problem from Chase but more so the airports ability to clear through the thousands of customers each day.

I just think it would make more sense if you choose between this benefit or something else like a CLEAR credit.

That in my opinion would make the card more valuable to more people who don’t want the TSA PreCheck Or Global Entry.

What I Like

Now the last thing that I really like about the Chased Sapphire Reserve Card is actually split into two benefits.

So the first benefit is the ability to earn a substantial amount of points on travel related expenses.

And as I travel a lot, this really makes the card that much more valuable to me.

I specifically book my flights through Chase Ultimate Rewards, which earns me 5x points.

Then when I book a Turo Car booking, I earn 3x points, as it is considered a travel expense.

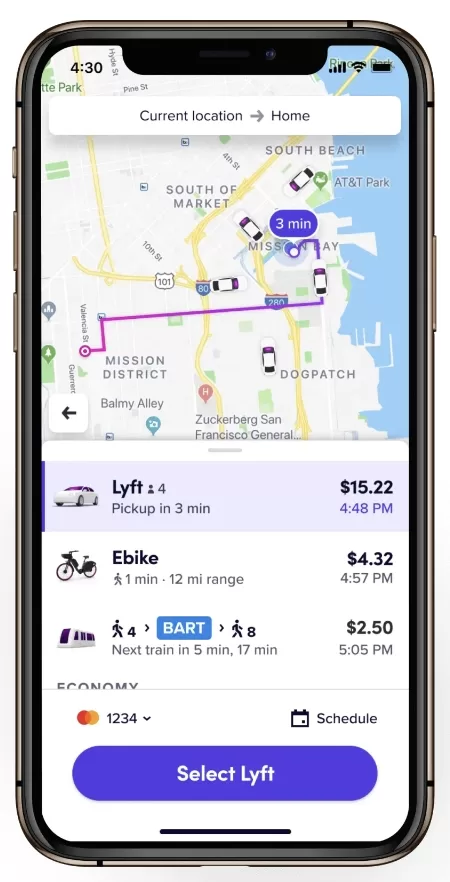

And then if I don’t have a car and need to get around the location I am visiting, I just book Lyft ride which actually earns me 10 x points.

So throughout the year I can earn a decent amount of points from my spending habits, which can then allow me to get a ton of value by using these points.

So throughout the year I can earn a decent amount of points from my spending habits, and this brings me on to the last thing that I really like with this card.

Which is the ability to transfer my chase points at a 1:1 ratio to 11 different airline partners and 3 different hotel partners.

And if this is done effectively it is possible to reave a ton of value.

More often than not I transfer my points over The World Of Hyatt as it is possible to find some really good deals if you take your time looking for them.

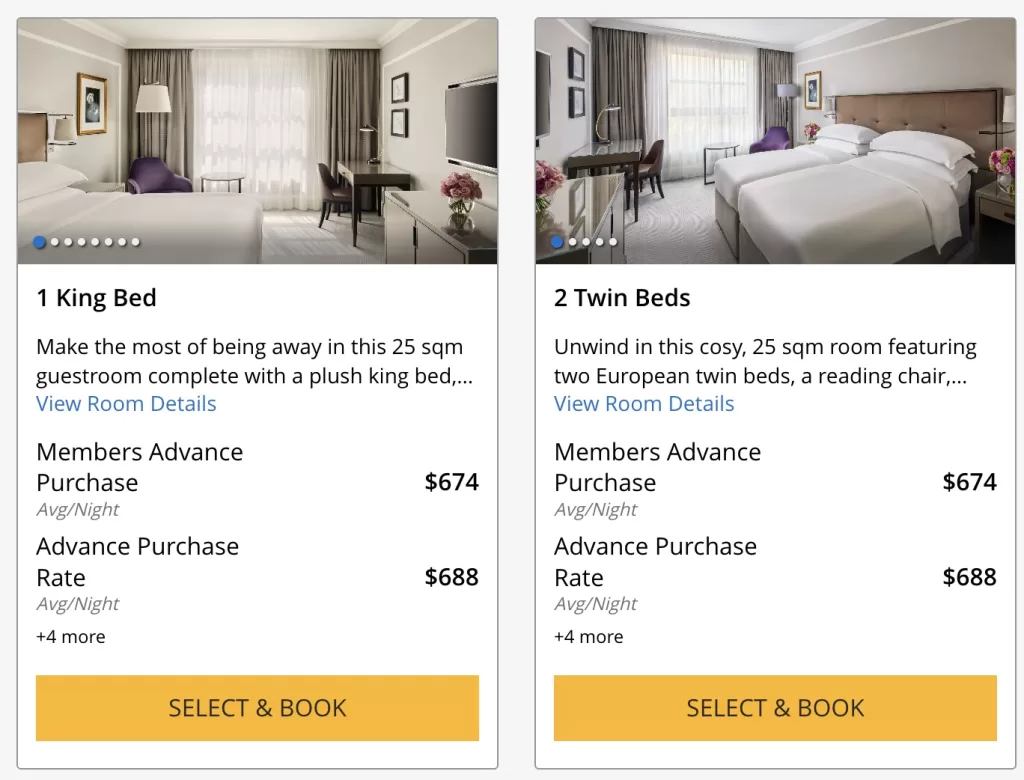

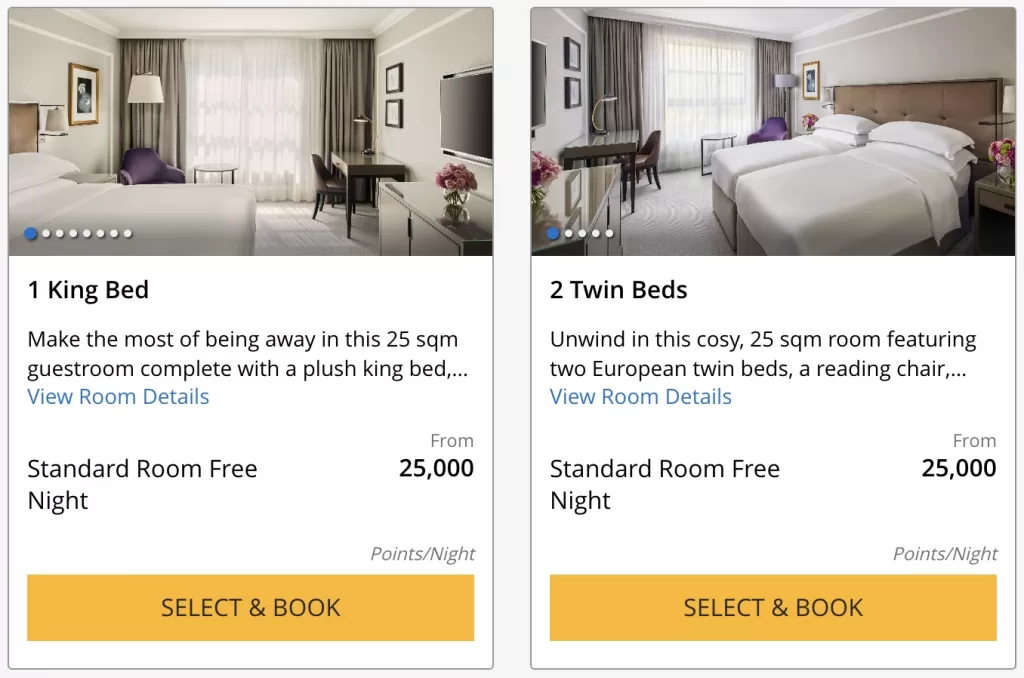

For example, last year I booked a room at The Churchill which is a Hyatt Regency hotel.

And as you can see here a room with 2 twin beds costs $674 a night for members.

But If you use points it only requires 25,000 points.

This values the points at around 2.7 cents per point, which is really good value.

Another way to look at this would be if you spent $2,500 on hotels, car rentals or Chase dining all through Chase Ultimate Rewards.

Seeing that these categories will earn you 10x points means you would receive 25,000 points in return.

Which then means you could then technically stay at this hotel I stayed at for free, which is pretty much exactly what I did.

So if you take to time time plan out where the best categories are to spend with the card, and then where you can get the most value from the points you earn, it is possible to receive a ton of value.

Final Thoughts

So in reality I still really like the Chase Sapphire Reserve card just as much as when I first received it back in 2016.

And as you can see in this article, I am able to get quite a lot out of this card in terms of value, and I haven’t even mention some of the other benefits that come with this card.

Now you might be wondering what I think about the more affordable Chase Sapphire Preferred card, which is just $95 a year.

Well, I think that this card is also fantastic value, and can potentially make more sense for some people depending on how much you travel throughout the year.

If I didn’t travel overseas so much and spend so much time at different airports all over the world, I would be perfectly happy with the Chase Sapphire Preferred card.

Now if you want to see how this Chase Sapphire Reserve card compares to the American Express Platinum card and at the Capital One Venture X card , Ive created an in-depth review of the best credit card for 2024 that you can read right here.